20th Century Insurance Out of Quake Action

In a move certain to shake up the Southern California insurance market, earthquake-battered 20th Century Insurance Co. said Thursday that it will stop selling earthquake policies immediately and phase out all homeowner coverage over the next two years.

The big insurer’s exit increases fears that consumers--especially in the Los Angeles Basin--will have trouble finding earthquake insurance.

In Orange County, 34,894 homeowner policy holders who have insurance with 20th Century will have to look elsewhere. They represent 14.7% of the company’s business statewide.

The action also prompted renewed calls for a national catastrophe insurance program such as the Natural Disaster Protection Act now before Congress.

Woodland Hills-based 20th Century said it will take no new customers in either homeowner or earthquake insurance, but will concentrate on the cut-rate auto policies that form the bulk of its business and have fueled its 30 years of fast growth and high profits.

20th Century’s action, negotiated last month with Insurance Commissioner John Garamendi, directly affects 240,000 homeowners and condominium policyholders, the majority of whom live in Los Angeles and Orange counties.

“Many of our customers have already suffered the disrupting effects of the Jan. 17 earthquake,” Neil H. Ashley, chief executive, said in a statement Thursday.

“We realize this is one more inconvenience, but it is the right thing to do,” he added, citing about $600 million in quake claims that wiped out two-thirds of the insurer’s surplus, or cushion against losses.

Disruption aside, it will cost policyholders money.

Garamendi granted the company an immediate 17% increase on its homeowner rates, which will bring the average annual premium to $365 from $317, based on $117,000 of coverage.

That is still cheap compared with the average of $441 in Orange and Los Angeles counties. The average premiums for several Orange County cities are lower than the county average of $441, with an average annual premium of $361 for Anaheim, $343 for Huntington Beach and $336 for Mission Viejo, according to state figures.

However, existing homeowner policyholders will be allowed only two more annual renewals before they are forced to shop elsewhere.

The insurer’s 90,000 earthquake policyholders must find another carrier by their next renewal date.

Garamendi said in a statement that he did not expect consumers to have trouble finding replacement coverage, but others have predicted problems.

“If he says the market will absorb 20th Century (customers) no problem, I say, well, who?” said Stephen L. Young of the Independent Insurance Agents and Brokers of California, a trade organization.

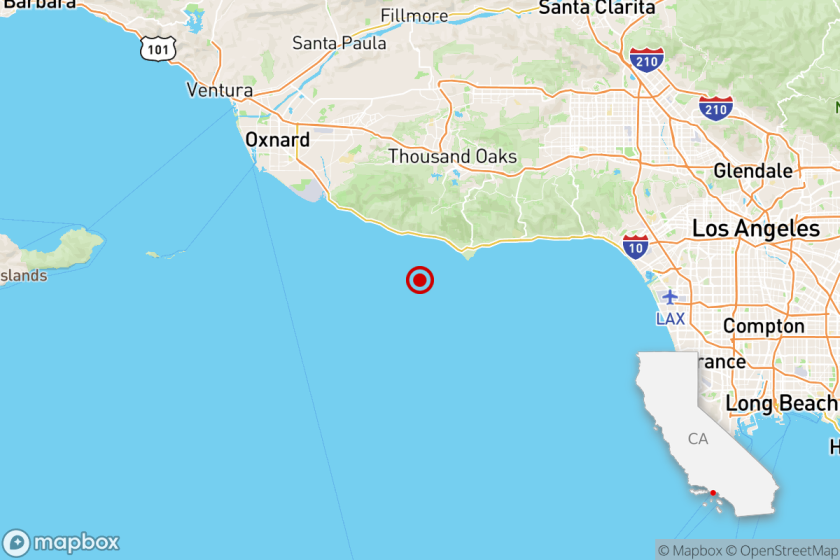

Since the Northridge earthquake, insurers have moved to curtail the growth of new earthquake and homeowner coverage in Southern California, Young said.

He said it will be especially difficult for customers with quake-damaged homes to find new coverage.

State Farm, the state’s largest carrier with 20% of the market, recently began a “managed growth” program for its California homeowners line, limiting the amount of new business it accepts.

“We’re taking steps to limit our exposure,” spokesman John Millen of No. 3 Farmers Insurance Group said Thursday. “It’s the prudent thing to do.”

Farmers recently raised the deductible on its quake policies to 15% from 10% and is “seriously reviewing the need for increased rates,” Millen said.

Millen said the real answer would be enactment of the Natural Disaster Protection Act, whose passage this year is uncertain.

The proposed legislation would create a national pool for disaster coverage with a disaster insurance component built into all homeowners’ policies. The premiums would be adjusted for regional risk of quakes, hurricanes, wildfires or other catastrophes.

The departure of 20th Century--the eighth-largest homeowner insurer statewide and believed to be the fourth largest in Southern California--also may put upward pressure on homeowners’ insurance rates over the long term, since 20th Century has been the low-price leader for the 12 years since starting that line of coverage.

In the short term, Garamendi noted that no other carriers have sought rate increases in homeowner insurance since January.

20th Century’s withdrawal was forced by its shocking, $340-million first-quarter loss, brought on by more than 41,000 earthquake claims. On the day of its annual meeting two weeks ago, company directors voted to suspend the company’s dividend for the rest of the year.

Garamendi has ordered 20th Century to raise its surplus to $250 million by June 30, from the current level of $188 million. Analysts said the low-debt company could easily achieve that by bank borrowings.

Times staff writer Debora Vrana contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.