Ex-athlete gets 5-year sentence in Ponzi scheme

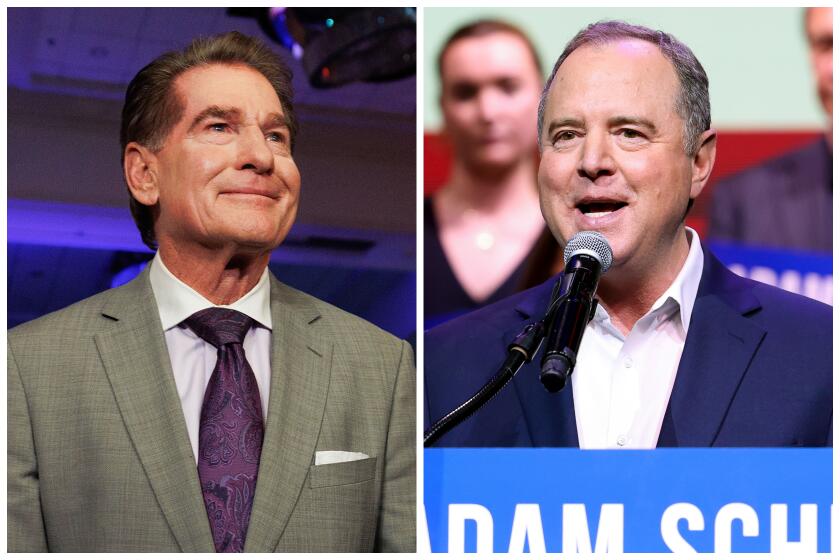

Despite a strong show of support from Steve Garvey and a handful of victims, a former Cal State Fullerton baseball player who hired the onetime Dodgers star to promote his mortgage company was sentenced Monday to five years in prison for stealing $32 million from more than 200 investors through a real estate scam.

An apologetic Salvatore “Sam” Favata also was ordered by U.S. District Judge Andrew J. Guilford to compensate his victims at a rate of $10,000 a month when he is released from prison.

Guilford told Favata he was lucky to have so many friends who still trusted him, including many clients of his Orange-based National Consumer Mortgage firm, which had a legitimate home loan business. Favata had persuaded clients to refinance their homes and use the cash, and other assets, to invest in another arm of the company, promising investment returns of 30% to 60% a year.

An investigation, triggered by tips to the Securities and Exchange Commission, revealed that little of the money was invested. Instead, Favata was paying earlier investors with funds from new investors in what is known as a Ponzi scheme.

Garvey, who was hired as a pitchman for the legitimate loan business, sat in a packed Santa Ana courtroom with former Dodgers shortstop Maury Wills among a group of investors who tried to persuade the judge to spare Favata prison time. Doing so would allow him to pay back his victims, they said.

“It’s a sad day,” Garvey, who did not speak at the sentencing, said after the hearing.

Garvey, who was unaware of the scheme, said he sent a letter to the judge in support of Favata, who as a 12-year-old introduced himself to the former Dodgers first baseman on a golf course in Westchester.

Garvey said he thought the judge was evenhanded and that he had faith that Favata would “commit his life” to replacing what he took from investors. Whether Favata would be able to, Garvey acknowledged, was an open question.

“That’s a lot of money,” he said.

The sentence was the maximum allowed for the fraud charge for which Favata pleaded guilty under an agreement with prosecutors. Defense attorney Nathan J. Hochman asked for a sentence of three years followed by two years of especially strict home release.

The judge noted several times that he believed five years was “a relatively short term for stealing over $30 million.”

He also pointed out that Favata seemed not to have learned his lesson from a previous conviction for grand theft. In that case, Favata cashed a check for a fraudulent loan. He agreed to pay $150,000, and the charge was reduced to a misdemeanor.

Favata, a second baseman on Cal State Fullerton’s NCAA championship team in 1979 and draft pick by the Milwaukee Brewers in 1980, was president of National Consumer Mortgage.

His reputation as an athlete and his link to Garvey apparently helped to lure investors into believing their money would be loaned at high rates to borrowers who needed short-term funding for real estate developments and other ventures, authorities said. Favata promised returns of as much as 60% a year.

Along with supporting the Ponzi scheme, the funds were used to pay Favata’s living expenses and debts and the expenses of his mortgage company, according to federal officials.

In court Monday, more than a dozen investors spoke emotionally of huge personal losses. Though united by their tales of ruin -- with $3 million in losses among them -- they were sharply divided over whether they should be seeking retribution against Favata or restitution from him.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.