Why the grim reaper of retail hasn’t come to claim Best Buy

Best Buy still operates 1,600 outlets as it moves increasingly to online sales. (July 17, 2017) (Sign up for our free video newsletter here http://bit.ly/2n6VKPR)

Five years ago

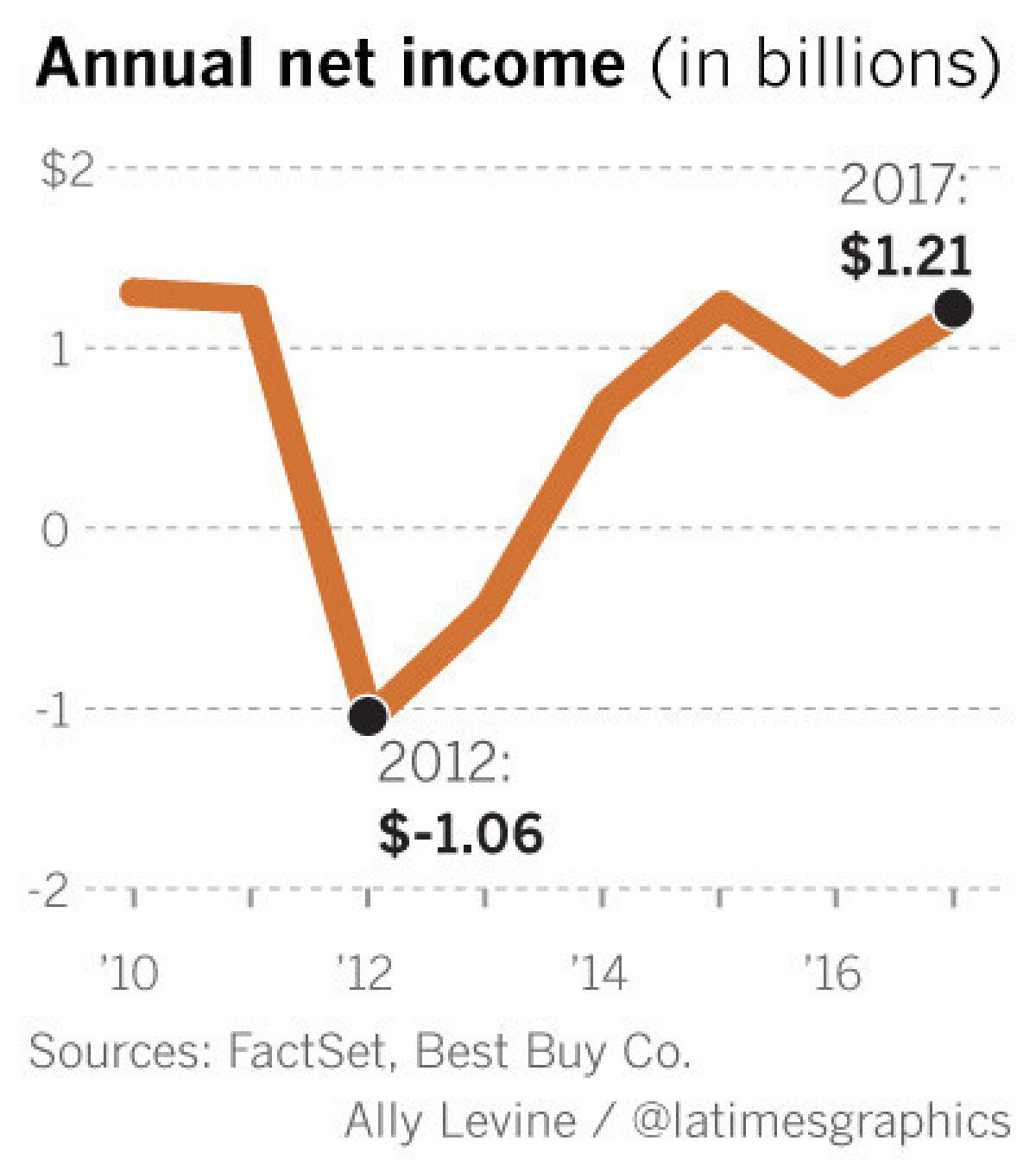

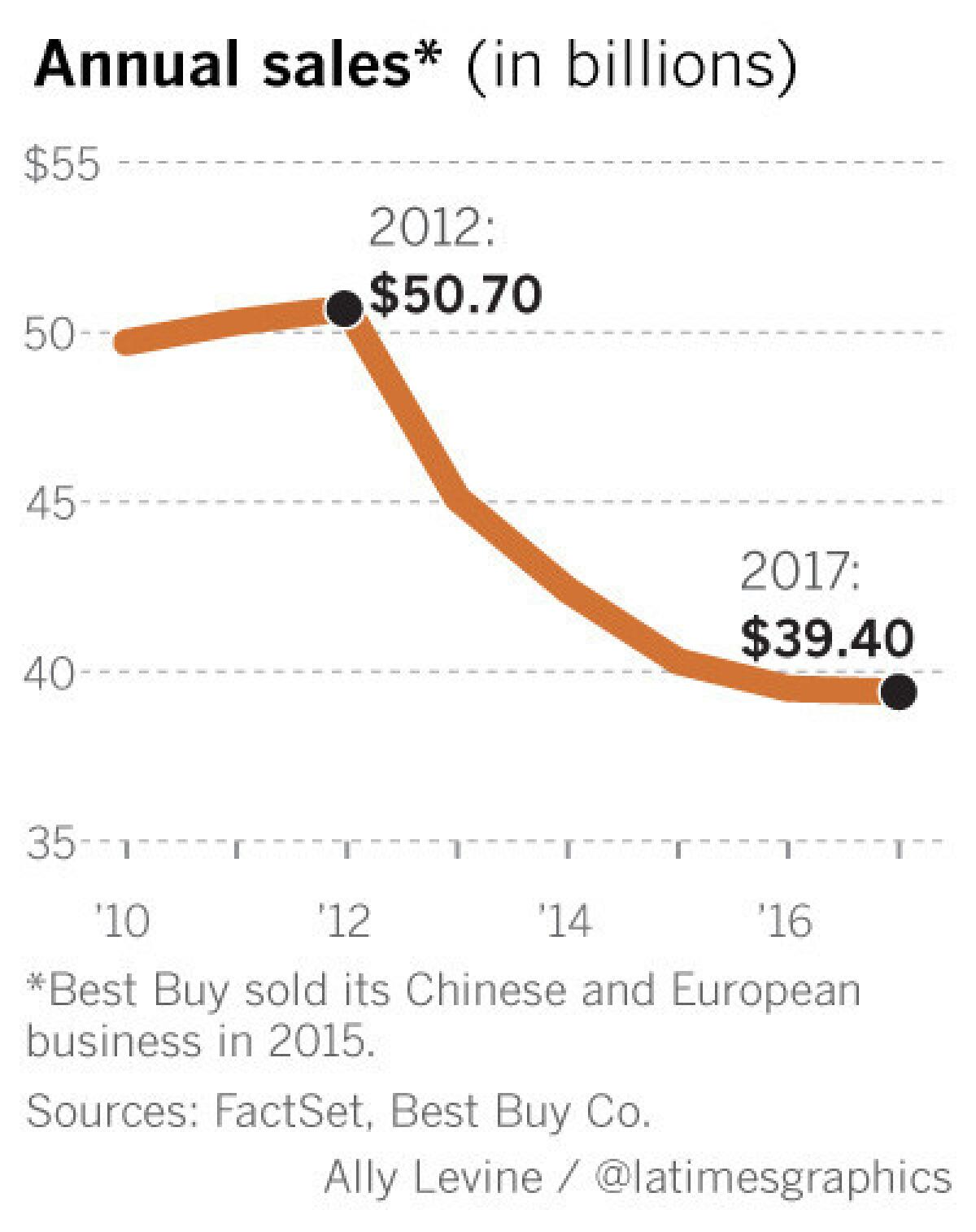

The big-box electronics chain was suffering dwindling sales and profits due in good part to “showrooming,” when shoppers would come in to a Best Buy store to check out televisions, computers and other items in person, and then buy them at cheaper prices at Amazon or elsewhere online.

Best Buy also was struggling with executive turmoil and facing a buyout threat from a major stockholder. The chain in 2012 named a new chief executive, Hubert Joly, but the Frenchman came from the hospitality field and had no retail experience.

His appointment stunned analysts, with one saying that fixing Best Buy was “a herculean task even for an accomplished retail executive.”

But Joly has proved up to the task so far. Under his turnaround plan, Best Buy has rebounded to remain one major U.S. retailer that’s holding its own in the face of Amazon’s relentless growth and the conventional retail industry’s slump.

Best Buy “came out the other side successfully to defend itself against Amazon,” said Peter Keith, an analyst with the investment firm Piper Jaffray & Co.

As more consumers shift to online shopping, other brick-and-mortar retailers have closed thousands of stores in shopping malls and elsewhere in the last year. A few have filed for bankruptcy protection, including rival electronics chain RadioShack.

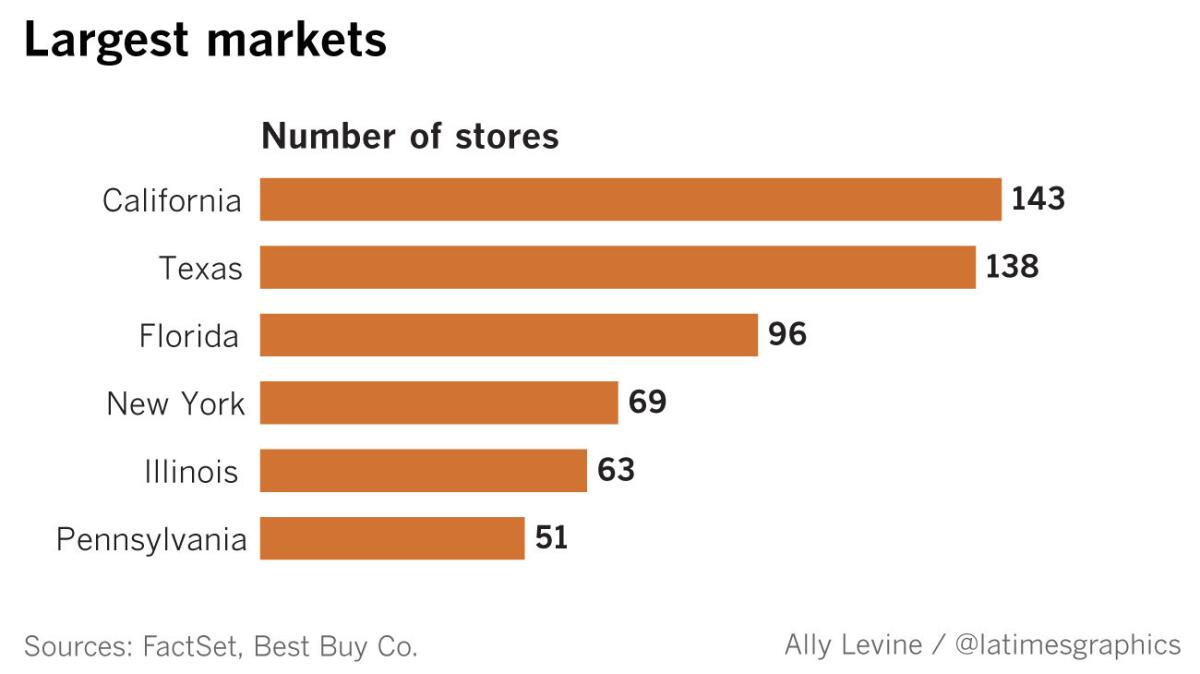

Best Buy still operates 1,600 outlets — including 143 in California, its biggest market — and Joly views the stores as “a great asset” even as Best Buy also moves increasingly to online sales.

“We don’t see ourselves as a brick-and-mortar retailer, we’re a multichannel retailer” that combines the stores, Best Buy’s website and its phone app to boost sales, Joly said in an interview. And he’s planning to expand Best Buy’s services, including its Geek Squad support arm, to generate more product sales.

Best Buy’s sales and profit have stabilized and its stock price, which closed at $55.26 a share Friday, has soared more than fourfold since late 2012, far outpacing the broader market.

The company’s same-store sales — that is, sales of stores open at least 14 months, and a key retail measure — have continued to rise modestly the last three years, reversing four years of declines.

Its domestic same-store sales edged up 0.3% in its fiscal year that ended Jan. 28, 2017, then jumped 1.6% in its first quarter ended April 29.

Best Buy’s U.S. online sales rose 21% in fiscal 2017 and accounted for $4.85 billion, or 12%, of Best Buy’s total sales.

But Best Buy’s overall annual revenue has remained flat because the consumer-electronics industry as a whole is growing less than 3% a year, according to some analysts.

“While economic conditions are gradually improving and will likely boost consumer spending, individuals are buying fewer of the big-ticket items that sustained rapid growth in the past,” the research firm IBISWorld said in a recent report.

“Consumer interest in big-ticket items, such as TVs and personal computers, has waned due to market saturation and slowing innovation,” the firm said.

That’s keeping the pressure on Richfield, Minn.-based Best Buy to keep wringing more profit from each dollar of revenue if it hopes to maintain its momentum. Joly (pronounced jo-lee) already has shown it can be done.

His first move was to match any rival’s prices, especially those at Amazon, so that in-store shoppers no longer needed to buy elsewhere.

“We had no choice, we had to take price off the table and match online prices,” Joly said.

That appeals to customers such as Scott Vellman of Los Angeles, who bought the “Battlefield 1” video game for his

“I bought it here [instead of online] because I didn’t want to wait for it to ship,” Vellman said.

Best Buy next sped up its delivery times, in part by expanding its national distribution centers, and beefed up its website and phone app so that customers could order online and pick up their products at the stores or have them delivered.

Many of the DVDs and CDs that once were a staple of Best Buy stores were cleared out, leaving room for Best Buy to invite such electronics vendors as Samsung,

“That enabled Samsung, for instance, to have 1,400 stores in the U.S. in our stores, which would have taken years to build” on its own, Joly said.

The inside-store vendors also include Pacific Sales, a seller of appliances, fixtures and other household products that Best Buy acquired in 2006, along with Magnolia, another Best Buy unit that sells premium audio and visual gear.

Best Buy shed its Chinese and European businesses in 2015. The company also has stripped $1.4 billion from its annual operating costs by renegotiating supply agreements and real estate leases and by closing more than a dozen large stores and 40 smaller ones, among many other steps.

The company plowed a chunk of the savings into better training its employees so that they can explain products to shoppers, which Joly believed was critical because new technology often is confusing to many consumers.

Best Buy, with 125,000 employees overall, “has done an excellent job improving customer service,” Keith said in a recent note to clients.

Juan Ortiz of Glendale, who was at the Atwater Village store to buy a Nest Cam security camera, noticed the difference.

“If I’m going to spend a few hundred [dollars] on a security system, I want to talk with the employees and make sure I’m getting the best one,” Ortiz said. “It also helps that they explain everything. If I got it on Amazon, I’d be on my own.”

Best Buy also is rolling out an in-home advisory service, where consumers get a free consultation on how to connect all the products in their homes, including TVs, computers, video games, thermostats and home-security networks, among others, and how they can be controlled by voice activation.

The consultations could lead to consumers buying more products or services, such as those provided by Best Buy’s Geek Squad. Currently, those services account for only 5% of Best Buy’s revenue.

Amazon also is quietly rolling out a program of free “smart home” consultations, as well as product installations for a fee, the website Recode.net reported last week.

Joly was not alarmed.

“They’re seeing the same thing we’re seeing — that customers need help — and are trying to address that,” he said of Amazon. “Just looking at a product on the shelf or a site doesn’t necessarily tell you what you can do with it.”

What’s already clear is that many shoppers still prefer peering closely at products on Best Buy’s shelves rather than relying solely on the Internet.

“I like picking out toys here because I can look at them,” 11-year-old Miguel Molina of Los Angeles said after he bought a Roblox pirate toy at the Atwater Village store. “On the computer, there’s only pictures.”

Twitter: @PeltzLATimes

ALSO

The Internet is mauling America's malls. Is your favorite retailer closing its doors?

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.