Gilead is buying Kite Pharma, a cancer-fighting Santa Monica biotech firm, for $11.9 billion

Santa Monica biotech company Kite Pharma Inc. is being acquired by industry giant Gilead Sciences Inc. in an $11.9-billion deal that demonstrates the promise of using a person’s own immune system to fight cancer.

Foster City-based Gilead said Monday that it would maintain and even expand Kite Pharma’s Los Angeles area operations, which include a 100,000-square-foot manufacturing facility in El Segundo.

Dr. Arie Belldegrun, Kite Pharma’s founder and chief executive, will help during the merger transition, a Gilead spokeswoman said, but she offered no details on leadership plans beyond that.

The purchase of Kite, which is on the verge of gaining approval for an innovative treatment, expands the cancer-fighting portfolio of Gilead.

“The acquisition of Kite establishes Gilead as a leader in cellular therapy and provides a foundation from which to drive continued innovation for people with advanced cancers,” Gilead Chief Executive John F. Milligan said in a statement.

Kite Pharma has a cell therapy treatment for non-Hodgkin’s lymphoma under review by the Food and Drug Administration that uses a patient’s immune cells to fight cancerous cells. Swiss drugmaker Novartis Corp. also is developing a similar cell therapy treatment for a rare form of leukemia, which is poised to become the first gene therapy to receive FDA approval.

Cell therapy, like many cancer treatments, is expected to be expensive. The costs to patients and providers could cause problems for Gilead, which has come under fire for the high price of its drugs.

Kevin Young, Gilead’s chief operating officer, would not say Monday what the treatment would cost. But he told analysts on a conference call that “I certainly think this innovation will support very healthy reimbursement.”

Gilead is to pay $180 in cash for each share of Kite Pharma, a 29% premium over the Friday closing price. Kite Pharma stock leaped 28% to $178.05 on Monday. Gilead shares rose about 1% to $74.69.

Since the start of the year, Kite Pharma’s stock price has nearly quadrupled. The shares got a significant boost after a study of the company’s gene therapy reported positive results.

The boards of both companies have approved the deal, and it’s expected to close by the end of the year.

Gilead has developed top-selling treatments for HIV and the liver-destroying hepatitis C virus, but leaders of the biotechnology company told analysts Monday that its push into oncology has been largely nascent so far.

Kite Pharma’s research and development, as well as commercialization operations, are to remain in Santa Monica. Manufacturing of Kite Pharma’s treatment is to continue at the facility in El Segundo. Kite Pharma has about 600 employees at the two facilities combined, company spokeswoman Christine Cassiano said.

Gilead was impressed with Kite Pharma’s team and plans to keep investing in its operations, said Gilead spokeswoman Amy Flood.

“The transaction is not about financial synergies or cost savings,” she said. “This is a growth area, and we anticipate we will increase the number of employees at Kite.”

Analysts said it made sense for Gilead to keep and even expand Kite Pharma’s Los Angeles-area operations.

“That manufacturing in L.A., that marketing team, I think is really, really critical in the process, especially when they’re about to launch in this area,” said Tony Butler, an analyst at Guggenheim Securities.

“It’s important that they keep that together,” he said.

Biren Amin, an equity analyst at Jefferies, said Gilead was unlikely to make a change to Kite Pharma’s operations with FDA approval of its treatment “right around the corner.”

“If one even thought about transferring it out of El Segundo, I think it would be next to impossible because you’d have to have that site up and running for product launch later this year,” Amin said.

Kite Pharma was founded in 2009 by Belldegrun, an Israeli-born cancer doctor with decades of experience in immunotherapy. It went public in 2014.

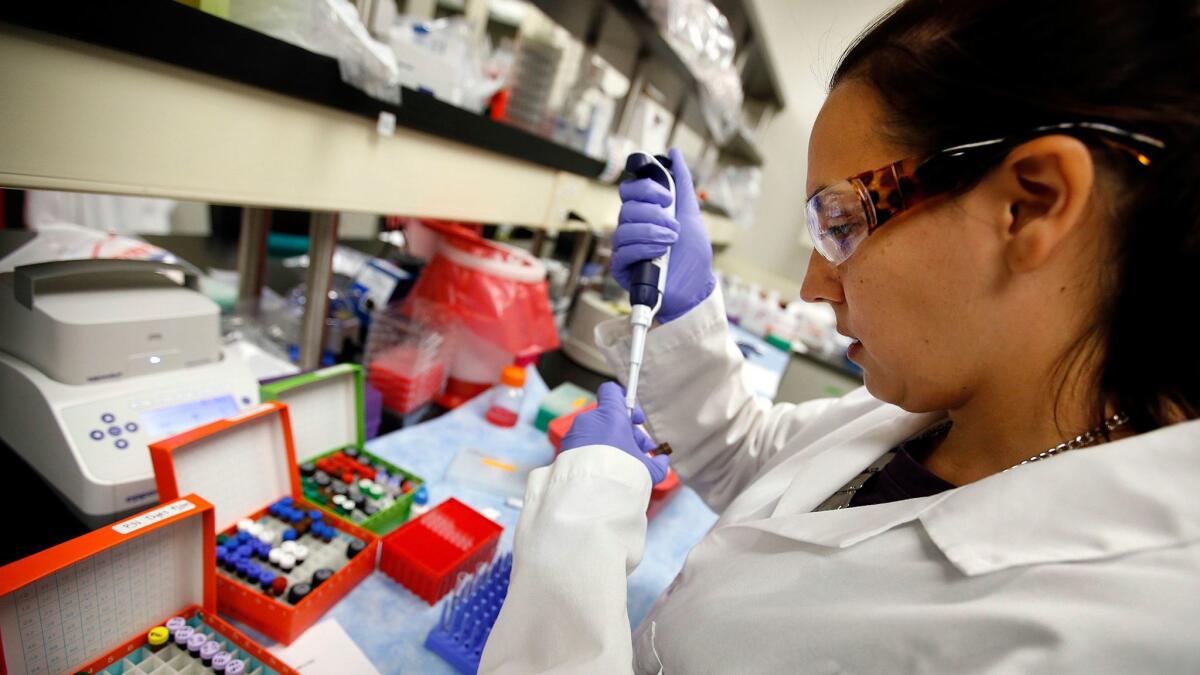

Its cancer treatment, called CAR T, involves reprogramming a patient’s disease-fighting T-cells to seek and destroy only abnormal, cancerous lymph cells. Healthy cells are not harmed.

The process involves drawing blood from a patient, refrigerating it and flying it to Kite’s facilities, where the cells are modified, frozen and then flown back to doctors who reinject them into patients.

In a 2015 interview with the Los Angeles Times, Belldegrun likened the cancer-fighting treatment to the navigation system in an automobile.

“The GPS will lead you to the cancer cell, and not the normal cell, and selectively kill only the cancer cell,” Belldegrun said.

In February, Kite Pharma reported that a major study of the gene therapy process found that more than a third of very sick lymphoma patients showed no signs of the disease six months after a single treatment. And 82% of patients had their cancer shrink at least by half at some point after the treatment, the study found.

“CAR T has the potential to become one of the most powerful anti-cancer agents for hematologic cancers,” Belldegrun said in a statement Monday. “With Gilead’s expertise and support, we hope to fulfill that potential by rapidly accelerating our robust pipeline and next-generation research and manufacturing technologies.”

Gilead was criticized two years ago for high prices for its hepatitis C drugs, including one that began at $1,000 per pill. The drugs were developed by biotech firm Pharmasset Inc., which Gilead acquired in 2011.

A bipartisan Senate Finance Committee report in 2015 said that Gilead put profits before patients in pricing the drug. Also, AIDS activists have complained about the prices of Gilead’s HIV medications.

The CAR T treatment could be expensive as well because of the complexities of the therapy. Novartis’ treatment very likely will hit the market first so Gilead will have that price to work from, said Alan Carr, an analyst at Needham & Co.

“There are a lot of oncology drugs right now that are expensive. There’s a lot of controversy around that,” he said. “I’m not sure that Gilead is particularly susceptible to that.”

The Associated Press was used in compiling this report.

Twitter: @JimPuzzanghera

UPDATES:

3:15 p.m.: This article was updated with information about Kite Pharma founder Dr. Arie Belldegrun.

1:25 p.m.: This article was updated with the closing stock prices for Kite Pharma and Gilead Sciences.

1:05 p.m.: This article was updated with analyst comment and additional details about drug pricing.

8:30 a.m.: This article was updated with details about Kite Pharma’s workforce and current stock prices.

7 a.m.: This article was updated with additional detail and the opening stock prices of Kite Pharma and Gilead.

6:45 a.m.: This article was updated throughout with staff reporting.

This article was originally published at 5:25 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.