Macy’s reversed its sales slump. But can the retailer sustain the rebound?

A year ago, Macy’s Inc. epitomized the nation’s troubled department-store chains.

Sales were mired in a years-long slump amid consumers’ increasing shift to online shopping, drooping mall traffic and competition from lower-priced apparel. Dozens of poorly performing stores were closed. The chain’s stock price had plummeted 65% from mid-2015 through last year, and Macy’s named a new chief executive, Jeff Gennette, in early 2017.

Then earlier this year, Macy’s — whose biggest market is California — signaled it might be pulling out of its slump.

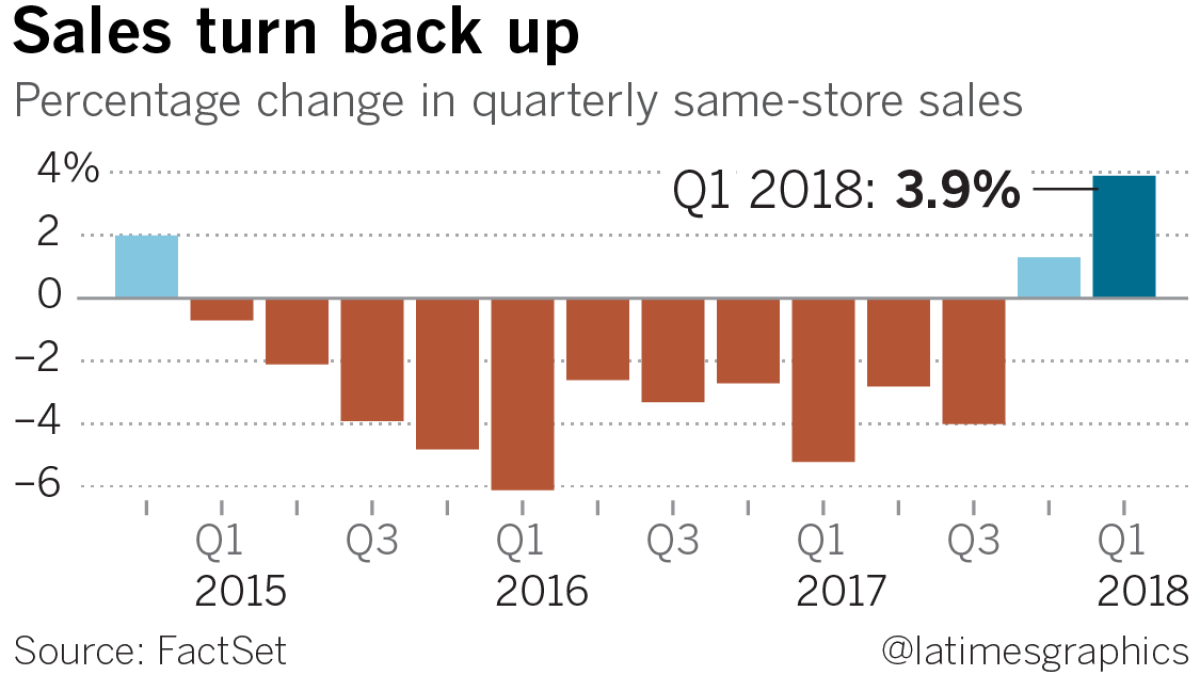

Macy’s same-store sales rose 1.3% in its fiscal fourth quarter ended Feb. 3 compared with a year earlier, the first quarterly gain in three years. A key gauge of a retailer’s health, same-store sales track revenue from stores open at least one year to minimize the effect of stores closing or opening.

Then, in the quarter ended May 5, its same-store sales jumped 3.9% from a year earlier, well above analysts’ forecasts.

That gain included the benefit of a promotional event that occurred in the second quarter a year earlier but was shifted to the first quarter of this year. Even after excluding that benefit, Macy’s same-store sales were up 1.7%.

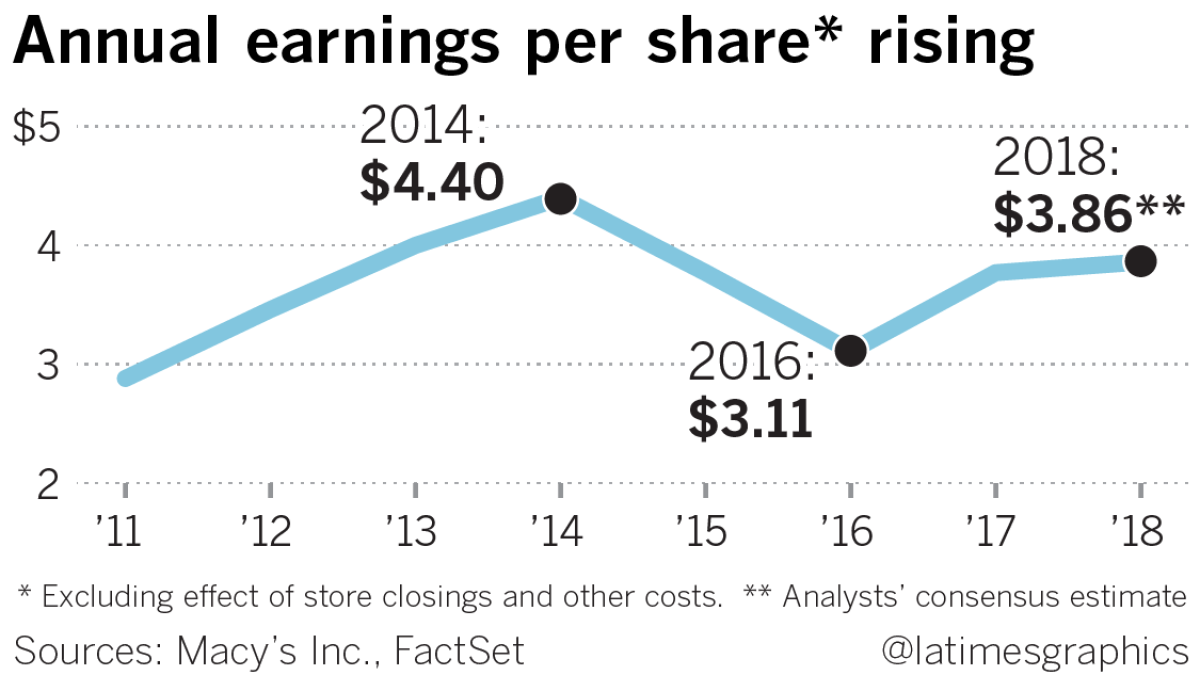

Macy’s also raised its projections for its full-year fiscal 2018 results. Investors, anticipating further improvement, have bid up Macy’s stock by nearly 70% in the last 12 months, outpacing the 50% gain in the S&P retail index over the same period.

The stock of Kohl’s Corp. has soared 79% in the last 12 months as that chain also has rebounded. But some others are still floundering, such as J.C. Penney Co., whose stock has plummeted 55% in the last 12 months — to less than $3 a share — as that middle-market retailer still struggles with flagging sales.

For Cincinnati-based Macy’s, two quarters do not necessarily make a trend, and some analysts remain skeptical whether Macy’s can sustain its growth over the long term, especially if consumer spending slows from its current robust rate.

“We fear that regaining market share in a highly competitive space is difficult to achieve” for Macy’s, Morningstar analyst Jaime Katz said in a note to clients after Macy’s first-quarter results were announced. “We have Macy’s continuing to trail overall apparel-market growth.”

For now, though, Macy’s is benefiting from external factors and strategic moves by Gennette, who spent most of his career at the chain before getting the CEO post.

Macy’s, with fiscal 2017 sales of $24.8 billion, operates about 850 stores nationwide. Its store brands include Macy’s, Bloomingdale’s and Bluemercury, an upscale beauty chain. In California alone, Macy’s has 148 stores and 24,000 employees.

The strong U.S. economy, consumer confidence, low unemployment and federal tax cuts have combined to give Macy’s and the overall retail sector a boost. Macy’s said strong foreign tourism shopping also has helped results.

U.S. consumer spending, for instance, rose a solid 0.4% in June following spending in May that was revised upward to 0.5% from its initial estimate of 0.2%, the Commerce Department reported.

Gennette told analysts in May that “we did have the wind at our back as consumer spending remained strong and we saw significant improvement in international tourism spending.”

“We anticipate this to continue through the year,” he said. “We still have a lot of work ahead of us, but store by store, quarter by quarter we are on the path to return Macy’s to consistent comparable-store sales growth.”

Gennette and other Macy’s executives declined to elaborate further ahead of the company’s Aug. 15 announcement of its fiscal second-quarter results and its next conference call with analysts.

Macy’s benefited internally from improving its online and mobile-app business, rolling out a new customer-loyalty program and offering more options for store pickup and delivery. The retailer also reduced excess inventory and revamped its shoe and fine-jewelry departments.

In addition, Macy’s has been expanding its discount unit called Backstage, with plans to open 100 of the Backstage sections within existing Macy’s stores this year.

Backstage gives Macy’s shoppers the option of buying lower-priced goods at a time when Macy’s faces a host of cheaper “fast-fashion” chains such as Zara, owned by Inditex of Spain, and H&M, retail shorthand for Hennes & Mauritz of Sweden.

The strategy resembles the one used by Nordstrom Inc. with its successful off-price Nordstrom Rack stores.

There is the risk that “putting Backstage in Macy’s stores could cannibalize [its] full-price business,” Katz said. But Gennette said that has not been the case so far, telling the analysts that “right now it’s working quite well with [Macy’s] getting more spend with existing customers.”

Brian Tunick, an analyst with RBC Capital Markets, said in a report last month that Backstage should add $228 million to Macy’s sales and add one percentage point to its same-store sales in the current fiscal year. He also expects Macy’s will keep adding about 100 Backstage centers each year for the next four years.

Macy’s rollout of Backstage makes sense as off-price retailing “continues to grow at the expense of traditional department stores,” Tunick wrote.

Trouble is, Macy’s otherwise is a traditional department store, and that means its business model needs to change further, said Ronald Friedman, co-head of the retail practice at Marcum, an accounting and advisory firm.

Macy’s should find ways to make its stores more compelling, perhaps with in-store restaurants, while also improving customer service and truly differentiating Backstage from the rest of the store by not constantly placing everything in the “full-price” section on sale, he said.

“Everyone knows that when you walk into a Macy’s everything is on sale, and I think that hurts them,” Friedman said.

In the meantime, “I’m a skeptic” about Macy’s long-term growth “because they’re mostly doing well because the economy is doing well,” Friedman said. “They’re riding the wave.”

Twitter: @PeltzLATimes

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.