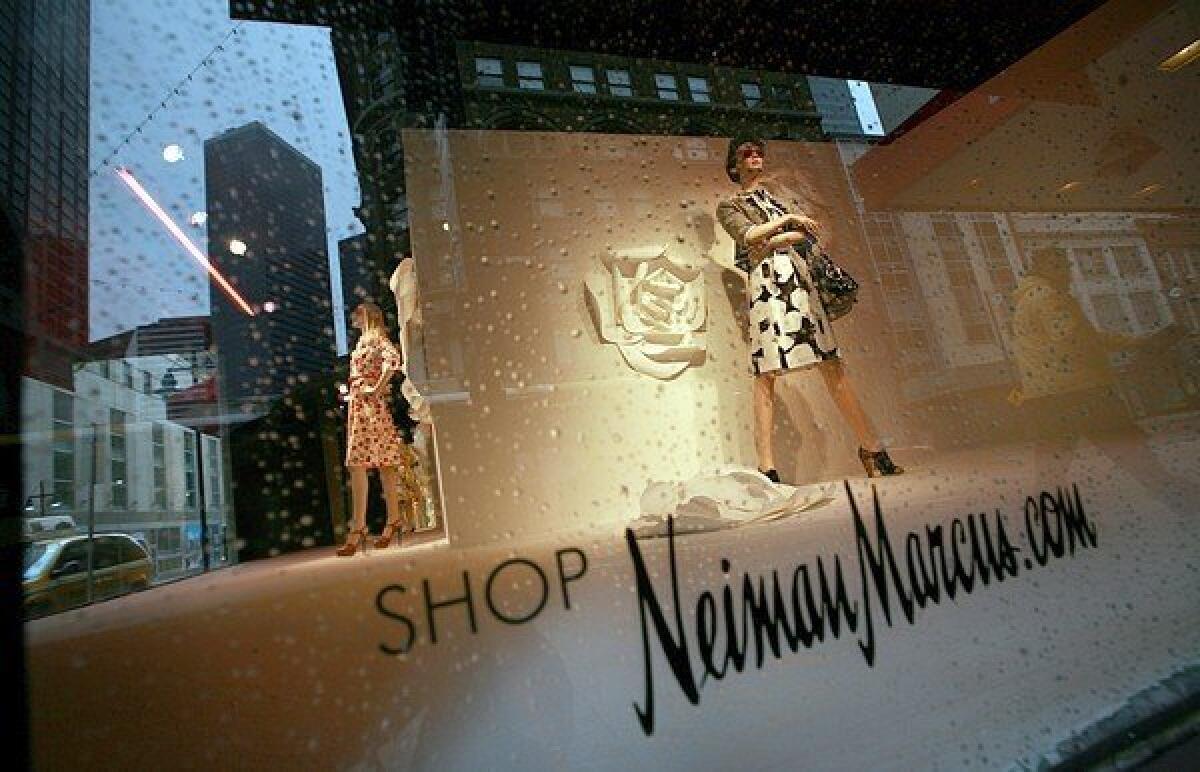

Neiman Marcus files for IPO, aims to raise $100 million

Neiman Marcus Inc., owner of luxury department stores stuffed with brands such as Prada, Chanel and Gucci, said in a regulatory filing Monday that it plans to raise up to $100 million in an initial public offering.

The Dallas company was taken over eight years ago for $5.1 billion by private equity firms TPG Capital and Warburg Pincus. The retailer did not disclose its projected IPO price range, how many shares it planned to offer or even its intended ticker symbol or host exchange.

Neiman Marcus operates 41 namesake stores in the U.S. as well as two Bergdorf Goodman locations. The company also owns 35 smaller Last Call and six CUSP outposts targeted at younger, budget-conscious shoppers.

In its filing with the Securities and Exchange Commission, Neiman Marcus said it has been riding a surge of high-end shopping.

In its 2012 fiscal year, it reported revenue of $4.4 billion, up from $4 billion a year earlier. Its profit during the period also increased to $140.1 million from $31.6 million.

And the global luxury goods industry, which according to Euromonitor research has already grown an average of 4.2% a year since 2005, is slated to boom 7.2% a year from 2012 to 2017.

Since the start of the year, competitor Saks Inc. has seen its stock boom more than 27% to $13.39 a share Friday.

ALSO:

Lululemon cracks jokes, plans men’s stores amid controversy

Neiman Marcus settles complaints it sold real fur labeled ‘faux’

Lowe’s aims to acquire Orchard Supply Hardware amid OSH bankruptcy

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.