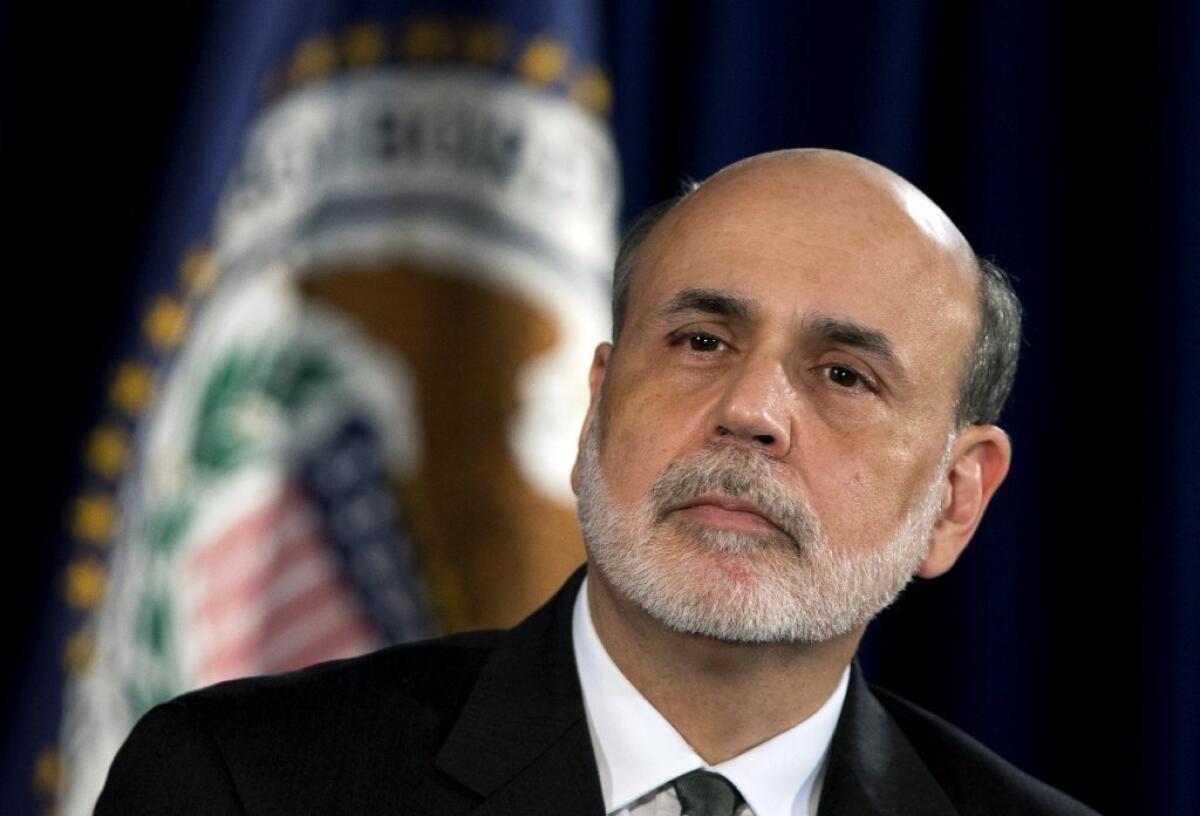

Bernanke warns Congress that budget cuts pose danger [Updated]

WASHINGTON -- Federal Reserve Chairman Ben S. Bernanke warned Tuesday that the upcoming budget cuts under the so-called sequestration would create a “significant” burden on an economy that is growing only moderately.

In his semi-annual economic report to Congress, the Fed chief urged lawmakers and the Obama administration to “consider replacing the sharp, front-loaded spending cuts required by the sequestration with policies that reduce the federal deficit more gradually in the near term but more substantially in the longer run.”

He told the Senate Banking Committee that the sequestration set to take effect March 1, which would cut federal spending by $85 billion this year, and other recent near-term budget changes could create a “significant headwind for the economic recovery.”

“Besides having adverse effects on jobs and incomes, a slower recovery would lead to less actual deficit reduction in the short run for any given set of fiscal actions,” he said in prepared remarks.

Bernanke said that the economy was continuing to grow at a moderate pace and that the flattening of growth late last year did not indicate a “stalling-out” of the recovery, but instead reflected weather-related disruptions and other transitory factors.

Still, Bernanke again highlighted the weakness and hardships in the labor market, noting the high unemployment rate and the millions of people struggling with long-term joblessness and the inability to obtain full-time work.

In addition to the slow recovery and the risks of sequestration, Bernanke’s remarks came as the U.S. and the world faced renewed threats from the Eurozone debt crisis, which had quieted since late last year but reawakened this week in the wake of an impasse in Italian elections.

Bernanke, in a question-and-answer session after his testimony, was expected to address those economic conditions as well as increased concerns about the effectiveness of the central bank’s aggressive monetary stimulus to support the weak economy.

Inside and outside the Fed, experts and policymakers are concerned that the Fed’s easy-money policies could be sowing the seeds of runaway inflation, asset bubbles and unstable financial markets down the road.

[Updated 2:30 p.m. Feb. 26:

In his exchange with the senators, Bernanke laid out a case for why the central bank should keep priming the economy with plenty of monetary stimulus. He said the Fed’s bond-buying and other efforts to hold down interest rates had helped the housing market and sales of cars and other goods, essentially arguing that the benefits outweighed the risks.

He said he didn’t see much evidence of a stock market bubble, and he pushed back against accusations that he was soft on inflation.

Responding to Sen. Bob Corker (R-Tenn.), who called Bernanke the “biggest dove” on inflation “since World War II,” the Fed leader said “my inflation record is the best of any Federal Reserve chairman in the postwar period, or at least one of the best, about 2% average inflation.”

The record of the Bernanke years has been notably less stellar on unemployment. The Fed has a dual mandate: to control inflation and to maximize employment. Liberal critics have said Bernanke has done too little to stimulate the economy to bring unemployment down, even as conservatives have accused him of doing too much.

Corker and some other lawmakers also questioned Bernanke about the Fed’s sharply increased holdings of Treasury and other government securities. They raised concerns that when the time comes for a reversal of the Fed’s stimulus measures that it could destabilize financial markets or lead to losses instead of the gains on assets that the central bank has been remitting to the Treasury.

Bernanke acknowledged that those remittances would decline if the economy strengthens or if interest rates were to rise quickly. Still, he expressed confidence that the Fed had the tools to tighten monetary policy without doing undue harm.

Sen. Pat Toomey (R-PA) asked: “What would the impact be of actually having to liquidate a big portion of your holdings on the bond market, on the equity markets?”

“We don’t anticipate having to do that,” Bernanke replied. “We could exit without ever selling, by letting it run off,” he said, referring to the Fed’s holdings of mortgage-backed securities.

Bernanke added: “Senator, if I can just make one very quick point -- there’s no risk-free approach to this situation. I mean, the risk of not doing anything is severe as well. So we’re trying to balance these things as best we can.”]

ALSO:

U.S. debt woes are not so dire, experts say

Average Americans are feeling pain of U.S. debt

Fed policymakers increasingly divided over monetary stimulus

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.