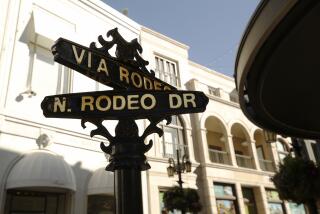

Why Chanel paid a record price for its Rodeo Drive location

Lofty price tags are the norm on Rodeo Drive, but one still managed to raise eyebrows on the swanky Beverly Hills street this week.

French luxury retailer Chanel bought the Rodeo Drive store it’s been leasing for $152 million, or $13,217 a square foot, a record price on a square-foot basis for retail space in California.

The sale reinforced Rodeo Drive’s status as one of the most exclusive shopping spots in the world, and it underlined how the three-block enclave — like commercial real estate generally — has continued rebounding from the severe recession of a few years ago.

SIGN UP for the free California Inc. business newsletter >>

Several retailers, such as the French fashion house Hermes, also have refurbished their stores or shifted locations on Rodeo Drive in the last three years to generate traffic.

The result is “the vacancy rate is extremely low” on Rodeo Drive, said Nima Bararsani, a first vice president with property manager CBRE Inc.

Populated with the likes of Chanel, Gucci, Louis Vuitton, Cartier and Prada, “it’s still one of the most iconic streets in the world,” Bararsani said. He added that some Rodeo Drive rents might climb above $900 a square foot next year from their levels of $550 to $700 before the recession hit in 2008-09.

Rodeo Drive ranks second among the most expensive U.S. retail streets, trailing only upper Fifth Avenue in New York, the commercial brokerage Cushman & Wakefield said in a report last month. Fifth Avenue rents range from $1,000 to $3,500 a square foot.

But some analysts said Chanel’s decision to buy its 11,500-square-foot store at the corner of Rodeo Drive and Brighton Way was partly about the retailer’s long-term strategic goals and not a direct response to any surge in consumer spending on expensive clothes, watches and other luxury goods.

Chanel owns another store next door to 400 N. Rodeo, the spot it just purchased, and the privately held company wanted to own both structures “ultimately to tie them together in some fashion” to create “a larger footprint” on the famed street, said Scott Kalt, a partner at Elkins Kalt Weintraub Reuben Gartside, one of the law firms involved in the transaction.

Chanel bought the store it was leasing from a partnership of two families that had owned the property since the late 1980s, he said, adding that the purchase was “a unique situation of a tenant that wanted to be an owner.”

Indeed, “the Chanel decision to buy that space has more to do with investment and brand-building than with retail [sales],” said Pam Danziger, founder of Unity Marketing, which tracks the luxury goods business. “[Consumer] spending growth is very slow.”

The consulting firm Bain & Co. said in late October that for the last several years there has been “a deceleration of the personal luxury goods market” and it forecast a “significant slowing” of inflation-adjusted global sales growth to a modest 1% to 2% this year.

The wealthy who routinely shop on Rodeo Drive likely aren’t concerned about such trends, of course. After all, this is a street where a Capucines handbag at Louis Vuitton can set you back $4,800.

But Rodeo Drive also relies heavily on tourists, especially those from China and other nations, and their spending has been crimped by the dollar’s strength against other currencies this year.

In addition, China devalued its currency in August in response to that country’s economic slowdown, giving Chinese tourists less purchasing power.

Still, having a store on Rodeo Drive means much more to the retailers than the sales generated there. The stores’ location also is about promotion, advertising and building the merchants’ brands.

“Their challenge is to keep reinventing themselves, especially to attract the younger customer,” said Chuck Dembo, a partner at Dembo Realty in Beverly Hills.

That’s especially crucial now with the pervasiveness of social media, said Jay Luchs, executive vice president of the real estate agency Newmark Grubb Knight Frank.

With the likes of actor Ben Affleck and singer Rihanna known to stroll along Rodeo Drive, a photograph of a celebrity in front of a retailer’s store can mean instant global attention today, Luchs said.

The stores “want to be in front of Hollywood as well as the fashion business … in today’s social media world, where people worldwide can look at Instagram in two seconds and see fashion trends,” he said. “Everyone is able to see instantly what celebrities are wearing.”

Chanel also is following other venerable luxury retailers in wanting to own its Rodeo Drive property rather than keep leasing.

The prior record price for retail space on Rodeo Drive was set in 2013 when LVMH Moet Hennessy Louis Vuitton bought its 7,100-square-foot property for $85 million, or $11,971 per square foot, according to Kalt’s law firm.

“At some point it makes sense to buy the real estate because they’ve been around for 150 years and they probably plan to be around 150 more,” Dembo said.

Twitter: @PeltzLATimes

ALSO

California’s Lemon Law helps protect pricey consumer electronics

Dow and Dupont to merge in a $130-billion megadeal, then split 3 ways

Loan to San Bernardino shooter draws scrutiny to online lending industry

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.