News Analysis: Boeing sacrificed quality on the altar of shareholder value

The 2019 column I most wish I could take back was about Boeing. In May, two months after the second deadly 737 Max crash, I compared Boeing’s current troubles to other times when Boeing had stumbled badly, including 2013, when the new 787 — which had come to market four years behind schedule — had a problem with its lithium ion batteries, which burst into flames several times. The Federal Aviation Administration even grounded the plane temporarily.

Airplanes are fiendishly complex, and new planes almost always have kinks that need to be worked out (though, admittedly, those kinks don’t usually include fatalities). In any case, my working assumption was that the company had always overcome its problems and would do so again. “Boeing’s history strongly suggests that it will recover from this fiasco and do so quickly,” I wrote. “It will emerge stronger than ever.” Ouch.

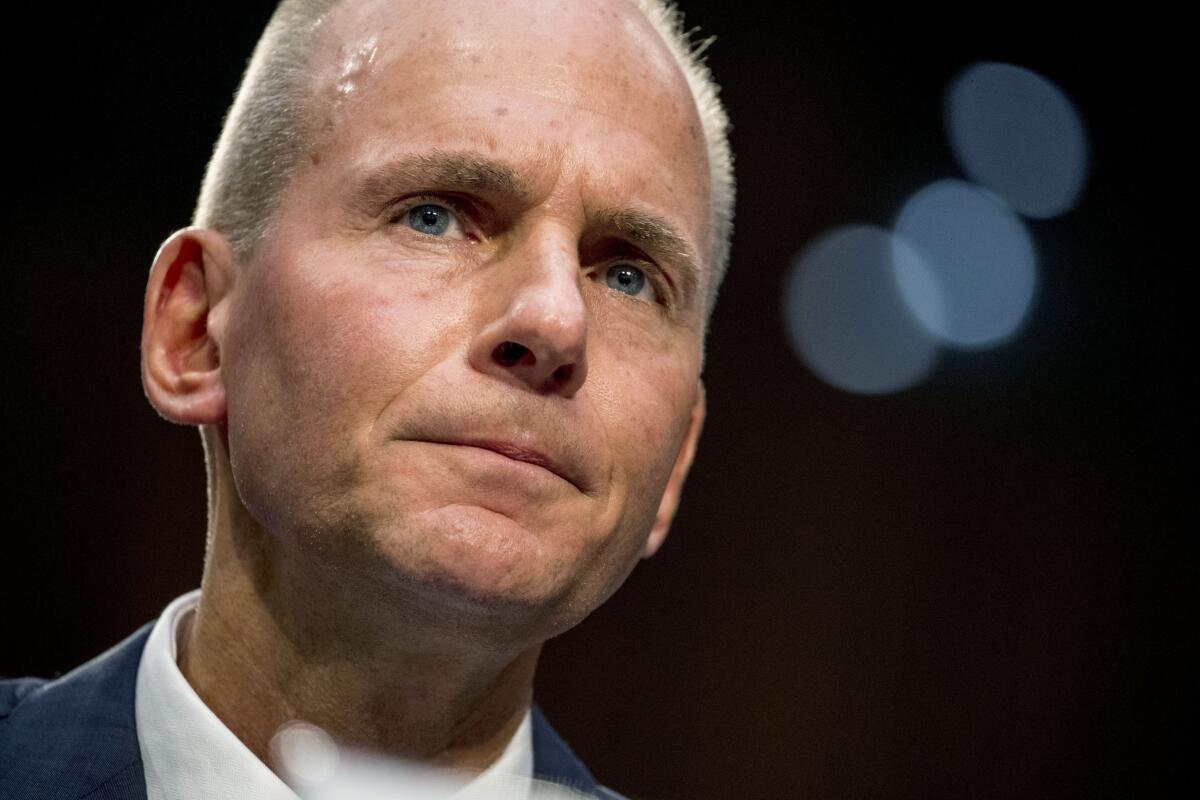

Within a matter of months, I could see that I was wrong and that Boeing was not the same company I had followed two decades earlier. In October, Chief Executive Dennis Muilenburg testified before Congress. He was awful. He kept saying that safety was part of Boeing’s DNA, yet the evidence that angry legislators confronted him with — internal emails, for the most part — suggested just the opposite: that safety was no longer high on Boeing’s list of priorities. What was ascendant was maximizing shareholder value, with catastrophic consequences.

The company cut corners to get the plane on the market quickly. It used the least expensive suppliers regardless of how inexperienced they were. Its manual contained only one sentence about the system that was the root cause of the crashes. Worst of all, it persuaded the FAA — and its airline customers — that pilots didn’t need flight simulator training to fly the 737 Max.

Boeing will be hobbled by the 737 Max affair for years to come. Yet the board that oversaw this calamity is not being held to task.

The release of a devastating batch of internal Boeing emails late last week — showing engineers rushing to get a plane to market despite knowing it had serious problems — only reinforced the notion that Boeing’s culture had been compromised. A company that had long been run by engineers for engineers was now a company run by corporate bureaucrats whose primary goal was to please Wall Street. That’s the underlying story those emails tell.

Which begs the question: How did this happen?

In the Atlantic magazine not long ago, business writer Jerry Useem suggests an answer. He marks May 2001 as the beginning of Boeing’s cultural decline; that month, top executives announced that they were moving the company’s headquarters to Chicago. More than 30,000 engineers would remain in Seattle, mind you. But the top 500 executives would move 2,000 miles away.

“When the headquarters is located in proximity to a principal business — as ours was in Seattle — the corporate center is inevitably drawn into day-to-day business operations,” Chief Executive Phil Condit said at the time. How he could view removing the top brass from the “day-to-day business operations” as a net positive is beyond comprehension. But he did. Useem wrote: “The present 737 Max disaster can be traced back … to the moment Boeing’s leadership decided to divorce itself from the firm’s own culture.”

Condit was ousted in 2003 (in part because he had a series of affairs with female employees) and was succeeded by Harry Stonecipher. Stonecipher, who had been chief executive of McDonnell Douglas when it merged with Boeing in 1997, had spent the bulk of his career at General Electric, including seven years under Jack Welch. As I’ve noted before, Welch’s stated goal was to make GE “the world’s most valuable company,” which meant focusing first and foremost on finding ways to increase the company’s share price. As his underlings took over other companies, they brought that mind-set with them.

Stonecipher was no exception. At Boeing, he gained a reputation as a ruthless cost-cutter and expressed pride in the way he was blowing up the company’s engineering mind-set. (“When people say I changed the culture of Boeing, that was the intent, so that it’s run like a business rather than a great engineering firm,” he once said.) Wall Street loved it; the stock price rose fourfold.

When Stonecipher was fired in 2005 (also for having an affair with a subordinate), the board passed over the obvious internal candidate, Alan Mulally, the head of the commercial airplane division and Boeing’s last great engineering executive, and brought in another Jack Welch protege, James McNerney. So now Boeing had a chief executive who knew nothing about how to manufacture an airplane. And this lack of engineering know-how was compounded when McNerny named Scott Carson to succeed Mulally, who left in 2006 to become chief executive of Ford Motor Co. True, Carson was a Boeing lifer, but he was a salesman, not an engineer.

In 2007, McNerney inaugurated a series of stock buyback plans, which lifted the stock price; it repurchased $6 billion worth of shares in 2014 alone. The CEO and other top executives received tens of millions of dollars’ worth of stock options and stock grants. Dividends were doubled. The stock bottomed out at $30 a share in the aftermath of the financial crisis, but by the time McNerney stepped down, it was approaching $150 a share.

Meanwhile, Boeing was putting the screws to its unions, eliminating their pensions and moving some production to a nonunion facility in South Carolina. Richard Aboulafia, the well-known aviation consultant, thinks this was a critical mistake — and another example of how little McNerney understood about the business of building airplanes.

“Aviation is not like other industries,” he write in Forbes after McNerney announced his retirement. “There are certainly cost pressures, but this is a capital-intensive business with very high barriers to entry. Labor costs just don’t matter as much compared to other industries.”

Aboulafia concluded: “An experienced and motivated workforce, therefore, is the most important asset a company has. McNerney failed to recognize this important fact, and the company has suffered as a result.”

In that same essay, Aboulafia noted that the incoming chief executive, Muilenburg, was an aviation engineer, and though he had spent his career on the defense side of the company, there was hope that he could reverse some of McNerney’s emphasis on the stock price. But it wasn’t to be. Instead, he ratcheted up the company’s stock buybacks, retiring 200 million shares — a quarter of the company’s stock — at a cost of $43 billion.

How could Boeing afford to do that? As Jonathan Ford pointed out last August in the Financial Times, it was precisely because it was saving so much money on the 737 Max. Instead of starting from scratch and building a new plane, it simply “bolted new fuel-efficient engines onto a tweaked existing airframe.” Ford concluded: “Boeing was able to redirect some of those ‘savings’ to repurchase stock instead.”

A set of stairs may have never caused so much trouble in an aircraft.

By the time Boeing decided to cobble together the 737 Max, its engineering culture was completely broken. Here’s how Aboulafia described it to Useem in the Atlantic:

“It was the ability to comfortably interact with an engineer who in turn feels comfortable telling you their reservations, versus calling a manager [more than] 1,500 miles away who you know has a reputation for wanting to take your pension away. It’s a very different dynamic. As a recipe for disempowering engineers in particular, you couldn’t come up with a better format.”

You can see that disempowerment — and its consequences — in the recently released emails. Instead of bringing their fears and complaints to superiors, the engineers grouse to themselves about the problems they see with the plane. They are bitter about management’s unwillingness to slow things down, to build the plane properly, to take the care that’s required to prevent tragedy from striking.

There is one email in particular from an unidentified Boeing engineer that I can’t get out of my head. It was written in June 2018, about a year after the company had begun shipping the 737 Max to customers:

“Everyone has it in their head that meeting schedule is most important because that’s what Leadership pressures and messages. All the messages are about meeting schedule, not delivering quality. ...

“We put ourselves in this position by picking the lowest cost supplier and signing up to impossible schedules. Why did the lowest ranking and most unproven supplier receive the contract? Solely based on bottom dollar. ... Supplier management drives all these decisions — yet we can’t even keep one person doing the same job in SM for more than 6 months to a year. They don’t know this business and those that do don’t have the appropriate level of input. ...

“I don’t know how to fix these things. … It’s systemic. It’s culture. It’s the fact that we have a senior leadership team that understand very little about the business and yet are driving us to certain objectives. It’s lots of individual groups that aren’t working closely and being accountable. ... Sometimes you have to let things fail big so that everyone can identify a problem. ... Maybe that’s what needs to happen instead of continuing to just scrape by.”

Of course that’s exactly what happened: the 737 Max failed big — at a cost of 346 lives. Shareholder value has caused much harm in the three decades since it became the core value of American capitalism: diabetics who can’t afford insulin; students ripped off by for-profit universities; patients gouged by hospital chains; and so much else. But none worse than this.

Nocera writes a column for Bloomberg.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.