Oil prices collapse below zero, scrambling the clean energy transition

The stunning collapse of oil prices Monday was the latest shock to an economy roiled by the coronavirus outbreak — and yet another jolt to an energy sector already grappling with a challenging transition from fossil fuels to cleaner power sources.

The price of West Texas crude fell to negative $37.63 per barrel as sellers scrambled to offload their May futures contracts before a Tuesday expiration date — even if they had to pay buyers to make the deal. The reason: With the pandemic bringing the economy to a standstill, there is so much unused oil sloshing around that American energy companies have run out of room to store it.

“The May crude oil contract is going out not with a whimper, but a primal scream,” said Daniel Yergin, Pulitzer Prize-winning oil historian and vice chairman of IHS Markit Ltd.

Contracts beyond May are still selling at relatively normal prices — oil for June delivery, which was a much more actively traded contract, closed at $20.43 a barrel — meaning this week may prove to be a low point for the oil sector. GasBuddy reported Monday that U.S. gasoline prices fell for the eighth straight week, to an average of $1.78 a gallon; in California, the average was $2.79.

But oil’s plunge into negative territory — which followed a months-long global price war started by Russia and Saudi Arabia, whose economies lean heavily on petroleum — is just one piece of a larger story playing out across the energy sector, with long-term implications for the world’s ability to phase out the fossil fuels that are responsible for rising global temperatures.

The COVID-19 pandemic is at the center of that story.

Coal-fired electricity generation has fallen to record-low levels on the U.S power grid, as stay-at-home orders have sapped demand and coal has struggled more than ever to compete with cheap solar, wind and natural gas. Analysts are predicting plunging sales for cars and trucks, including electric vehicles. In March alone, more than 100,000 American clean energy workers lost their jobs.

Planet-warming carbon dioxide emissions are down. But they could come roaring back as national economies reopen and energy demand recovers, which is what happened after the Great Recession caused a short-term downturn in global climate pollution.

It’s hard to predict whether the oil market turmoil will ultimately affect the transition to cleaner energy sources.

Energy researcher Alex Gilbert, a fellow at the Payne Institute at the Colorado School of Mines, said low oil prices typically hurt demand for clean energy and electric cars. Of the more than 150,000 gas stations around the country reported to GasBuddy, more than 120,000 were selling gasoline for less than $2 a gallon and nearly 40,000 of those were posting prices under $1.50 a gallon.

But there’s only so much cheap gasoline can do to goose petroleum demand when most people have nowhere to drive anyway.

And low oil prices may ultimately yield to higher prices as investment in the oil and gas sector slows, and as small- and medium-sized producers in the heavily leveraged U.S. shale patch go out of business. By the time oil demand recovers, Gilbert said, supply reductions could drive prices back up to $100 a barrel, tipping the economic scales back toward clean energy.

“The big question with clean energy is probably what happens on the policy side,” he said. “How much do China, the U.S. and the European Union pursue clean energy technologies as a stimulus method?”

We asked eight experts if the global mobilization to slow the pandemic might pave the way for climate action.

Jason Bordoff, a former energy policy advisor to President Obama, thinks there may be some opportunities coming out of the pandemic to reroute major industries toward lower emissions. For instance, he said, if the federal government ends up owning a significant stake in airlines or automakers, it might be possible to compel those companies to build less-polluting products.

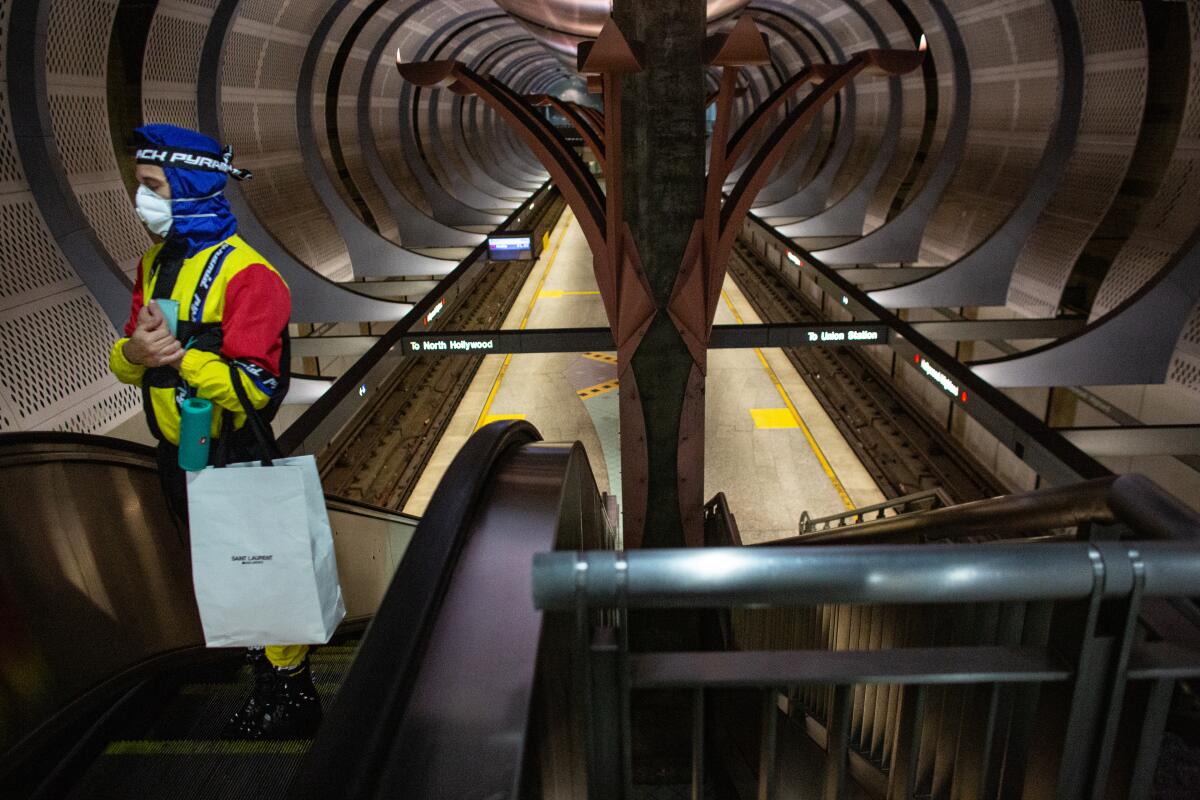

But Bordoff — who serves as founding director at Columbia University’s Center on Global Energy Policy — doubts the oil price collapse or COVID-19 will make much difference in long-term oil demand. Although there may be an uptick in working from home and less travel to conferences in some industries, oil demand could also see a boost if people are scared to return to public transit.

“I live in New York City,” Bordoff said. “I think a lot more people will want to take personal cars if they have them, or even Ubers, before they get back in the subway again.

“When economies are struggling and people are struggling, environmental ambition in government policy wanes,” he added.

With the science surrounding the novel coronavirus changing by the day — and death tolls continuing to rise around the world — it’s hard to predict anything with certainty, including how the virus might affect national commitments to reducing emissions.

Climate advocates have begun making the case that investing in clean energy would be one of the most effective ways for the federal government to jump-start sustained economic growth — and that propping up the oil and gas sector would be foolish.

Your support helps us deliver the news that matters most. Subscribe to the Los Angeles Times.

The Center for International Environmental Law, a nonprofit law firm, released a report last week arguing that even before the coronavirus outbreak, oil, gas and petrochemical companies “showed clear signs of systemic weakness.” Those signs included more than 200 bankruptcies over the last five years in the U.S. fracking industry, which is loaded with debt, as well as “growing investor skepticism about the long-term prospects for fossil fuels in a world that must act urgently to confront the climate crisis.”

Even Jim Cramer, the CNBC financial analyst, declared earlier this year that he’s “done with fossil fuels.”

That was in January. And now the coronavirus is taking another bite out of the oil and gas sector.

Monday’s price collapse showed just how oversupplied the U.S. oil market had become. An unprecedented deal by OPEC and allied oil-producing nations a week ago to curb supply is proving too little, too late in the face of a one-third drop in global demand.

Crude explorers shut down 13% of the American drilling fleet last week. Although production cuts are gaining pace, they’re not happening fast enough to avoid storage filling to maximum levels, said Paul Horsnell, head of commodities at Standard Chartered.

“There is little to prevent the physical market from the further acute downside path over the near term,” said Michael Tran, managing director of global energy strategy at RBC Capital Markets. “Refiners are rejecting barrels at a historic pace, and with U.S. storage levels sprinting to the brim, market forces will inflict further pain until either we hit rock bottom or COVID clears.”

On Monday, West Texas Intermediate for May delivery dropped as low as negative $40.32 a barrel. It’s far below the lowest level previously seen in continuation monthly data charts since 1946, according to data from the Federal Reserve Bank of St. Louis.

Congress approved $90 billion for clean energy during the Great Recession, providing a model for how lawmakers might boost the economy amid COVID-19.

Jigar Shah, president and co-founder of the clean energy investment firm Generate Capital, wonders if the pandemic might force oil companies to take climate-friendly technologies more seriously. Maybe, he said, the oil majors will “finally see the light” and stop pressing for government bailouts, and instead speed up their slow internal transitions to lower-carbon energy sources.

Shah sees a key role for state and local officials, especially given the oil sector’s now-obvious sensitivity to sudden loss of demand.

For instance, if California and other states that have adopted its strict fuel-economy standards were to ban the sale of new internal combustion engine cars, oil markets “would stay low forever,” Shah said — and consumers would save money on gasoline, too.

“A lot of governors and mayors are being educated by this now,” he said. “We’ll see if they act on it.”

Bloomberg contributed to this report.