Another day, another record on Wall Street as stocks inch up

Wall Street clawed its way to more records Monday, with stock indexes creeping higher after another listless day of trading.

The Standard & Poor’s 500 index inched up by 4.17 points, or 0.1%, to 4,701.70 after drifting between a small loss and gain throughout the day. It’s the eighth straight day the index has set an all-time high, tying its longest winning streak since April 2019, though most of the gains during this stretch have been only modest.

The Dow Jones industrial average rose 104.27 points, or 0.3%, to 36,432.22, and the Nasdaq composite gained 10.77 points, or 0.1%, to 15,982.36. They also set records, as did the smaller stocks in the Russell 2000 index, which rose 5.66 points, or 0.2%, to 2,442.74.

Stocks of construction-related companies made some of the strongest gains after Congress passed a $1-trillion infrastructure bill Friday. Vulcan Materials, which sells crushed stone and concrete, rose 4.9%. Equipment-maker Caterpillar gained 4.1%.

How do we define ‘infrastructure’? The new federal bill shows that we’re thinking about it differently

More broadly, the stock market has been climbing over the last month as a wave of reports has shown corporate profits were stronger during the summer than analysts expected. That’s helped calm investors’ concerns about inflation and the Federal Reserve starting to pull back on its massive efforts to support markets and the economy.

Slightly more stocks rose in the S&P 500 than fell Monday, with technology companies among those offsetting losses for utilities and companies that sell directly to consumers.

Advanced Micro Devices jumped 10.1% for the biggest gain in the S&P 500 after announcing that Facebook parent company Meta had chosen to use chips from AMD in its data centers. Chipmaker Nvidia rose 3.5%.

Steelmakers and other companies that stand to benefit from increased infrastructure spending also rallied after Congress’ passage of the infrastructure bill. Nucor gained 3.6%.

Friday’s deal eased some concerns over gridlock in Washington as a potential fight over raising the debt ceiling looms, said Jamie Cox, managing partner at Harris Financial Group.

“Markets had sort of come to the conclusion that infrastructure was going to take longer,” he said. “But it looks like maybe the logjam is broken; it really reduces the chances we’ll have a fireworks-laden Christmas.”

Social networking company Nextdoor Holdings jumped 17% in its market debut via a merger with a special purpose acquisition company.

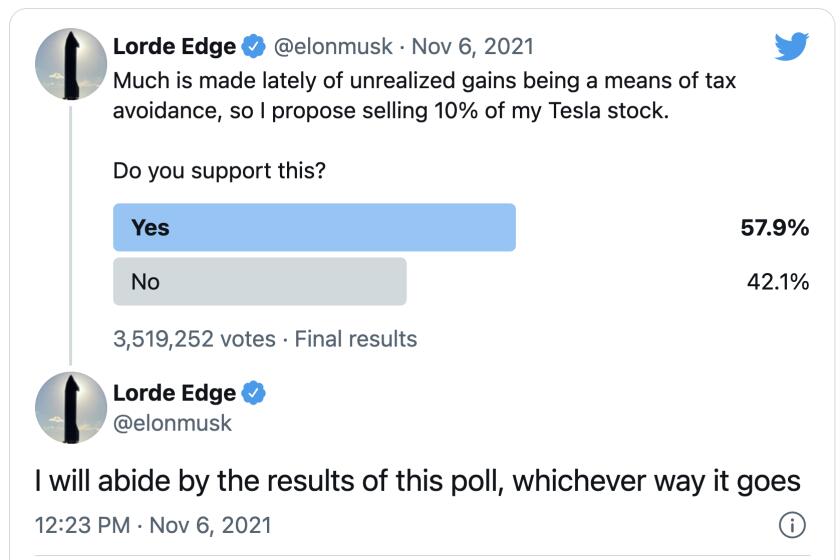

On the losing end was Tesla, which fell 4.8% after Chief Executive Elon Musk said he would sell 10% of his holdings in the company based on the results of a poll he conducted on Twitter over the weekend.

Elon Musk thinks tax policy is a game. He should be made to pay.

The latest round of corporate earnings is starting to wind down, but investors still have several report cards from some big companies to review. Healthcare services and products company Cardinal Health will report its financial results Tuesday and entertainment giant Walt Disney will report earnings Wednesday.

Wall Street will also get several updates on inflation this week. Rising inflation remains a key concern as companies contend with higher raw materials costs and supply chain problems, and consumers face higher prices.

The Labor Department will release its monthly update on inflation at the wholesale level Tuesday. The report showing what consumers are paying will come a day later.

The yield on the 10-year Treasury rose to 1.50% from 1.45% late Friday.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.