Column: Biden nominee Omarova faces an ugly attack because banks know she’d be a tough regulator

Amid all the crass stupidities and rank hypocrisy directed at Saule T. Omarova, President Biden’s nominee as comptroller of the currency, one remark stands apart.

“I don’t mean any disrespect,” Sen. John N. Kennedy (R-La.) told Omarova at her Senate Banking Committee confirmation hearing on Nov. 18 in his folksiest head-shaking manner. “I don’t know whether to call you ‘professor’ or ‘comrade.’”

Senate observers have long been accustomed to the Oxford-educated Kennedy’s Gomer Pyle act; if he chooses to play to the rubes gallery, all we can say is bless his heart.

I could not choose where I was born.

— Kazakh-born Saule Omarova defends her background during a confirmation hearing

In this case, however, he has used his schtick to advance one of the uglier attacks on a nominee in recent memory.

Its theme is that Omarova, who is a law professor at Cornell but was born and raised in the former Soviet Union, is some sort of secret communist bent on overturning the American way of banking.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Omarova’s upbringing has emerged as a principal concern for Republicans like Kennedy, and a small handful of congressional Democrats, because they’re fronting for the banking industry.

The banks want no one like Omarova in place as comptroller. There are two reasons. (Leave aside that Omarova would be the first woman or person of color to lead the agency.)

One is that she’s likely to shake up the agency, a banking regulator that has been so thoroughly captured by the industry that it serves as little more than a bankers’ fifth column embedded in the executive branch.

The other is that having studied American banking for the better part of three decades, she knows more about the industry than most bankers.

Industry campaigns to derail the appointment of anyone seen as a potentially tough and knowledgeable regulator aren’t uncommon. Witness the campaign waged by Amazon and Facebook against the appointment of Lina Khan as chair of the Federal Trade Commission, which was almost as personal as the war on Omarova, albeit rather less absurd.

Baggage fees, drug prices, net neutrality — Biden aims to reduce industry’s control of your daily life.

Biden stood fast with Khan, and she was confirmed in June. One hopes that he’ll stick with Omarova just as solidly.

The case against Omarova is rooted in her birth and upbringing in what was formerly the Kazakh Soviet Socialist Republic and is now independent Kazakhstan. Now about 55 — her actual birth date appears to be lost in the mists of the Soviet breakup — she received her baccalaureate at Moscow State University.

A star student, she was permitted to participate in a one-semester exchange program at the University of Wisconsin. She was there when the Soviet Union collapsed in 1991 and never returned home.

Kennedy and his fellow Republicans have mined this history to suggest Omarova is an unreconstructed communist. (Notwithstanding his denial, Kennedy’s questioning fairly dripped with disrespect.)

“You used to be a member of a group called the Young Communists, didn’t you?” Kennedy asked her. He appeared to be referring to the Komsomol, a youth league that all Soviet youngsters were encouraged to join in order to receive school promotions.

When Omarova explained that, adding that membership lapsed with age, he asked, “Did you send them a letter, though, resigning?” as if leaving the Komsomol resembled giving up the chair of a Louisiana gardening club. In any event, the Komsomol ceased to exist in 1991.

Omarova noted in replying to Kennedy, “I could not choose where I was born.”

She added, pointedly, that her family had suffered tragically at the hands of the Soviets. “I grew up without knowing half of my family,” she said. “My grandmother, herself, escaped death twice under the Stalin regime. This is what’s seared in my mind. That’s who I am.”

She might have added that since receiving her doctorate at Wisconsin and a law degree from Northwestern, she worked for six years at the corporate law firm Davis Polk, hardly a socialist hive, and served in the Treasury Department under President George W. Bush.

But this was all cynical posturing on Kennedy’s part, of course. Sen. Elizabeth Warren (D-Mass.), who has as finely tuned an antenna for phoniness as anyone in the Senate, had the opponents’ number.

JPMorgan got caught manipulating markets for the third time, but gets a sweetheart settlement from the feds

“Professor Omarova,” she said, “I know that the giant banks object to your willingness to enforce the law to keep our system safe and that you may cut into big bank profits. So the giant banks and their Republican buddies have declared war on you. The attacks on your nomination have been vicious and personal — we’ve just seen it. Sexism, racism, pages straight out of Joe McCarthy’s 1950s red scare tactics — it is all there on full display. Welcome to Washington in 2021.”

Let’s examine what really has the bankers in a dither about Omarova. Unlike their congressional henchpersons, they’ve focused on policy.

On Sept. 24, the day after Omarova’s nomination, American Bankers Assn. President Rob Nichols expressed concerns about “her ideas for fundamentally restructuring the nation’s banking system.” He accused her of proposing “to effectively nationalize America’s community banks.”

Nichols’ complaint derives from a paper Omarova published in October titled “The People’s Ledger.” There she posited the stimulating idea of transferring conventional savings accounts out of the hands of commercial banks and to the Federal Reserve.

In practical terms, the transfer would be voluntary on the part of depositors, though as Omarova observed, it would be more effective to simply transfer all such accounts to the Fed. In her view, this would solve, or at least ameliorate, numerous problems resulting from banks’ control of individual deposits.

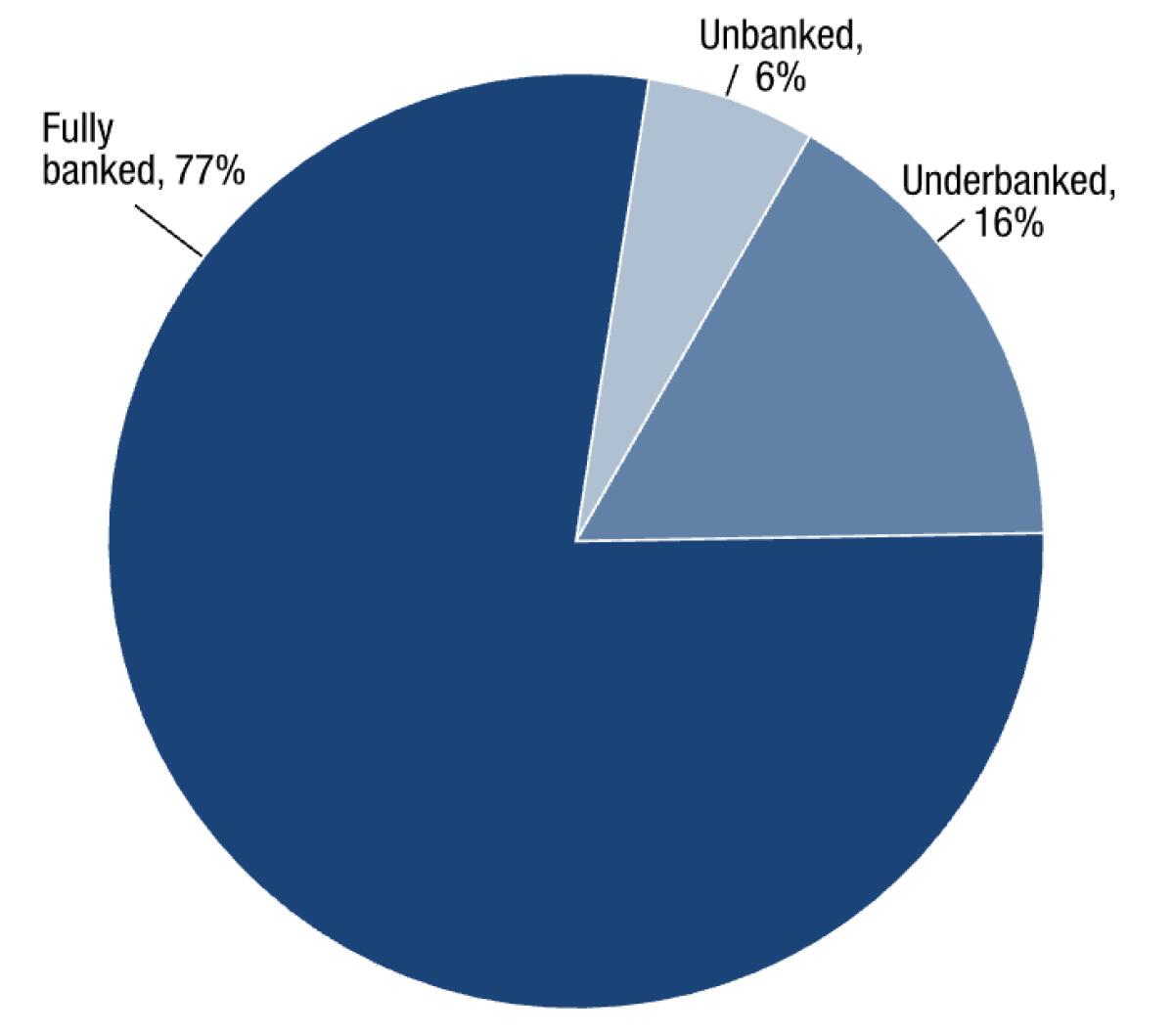

One is that a scandalously high percentage of Americans are “unbanked” — lacking access to bank savings and checking accounts and to bank credit. According to the Federal Deposit Insurance Corp., about 14.1 million adult Americans are unbanked, and an additional 40 million are “underbanked,” meaning that they have to resort to nonbank institutions such as payroll lenders for financial transactions.

That’s 22% of all households. It’s a direct artifact of banks’ profit-seeking, which places those accounts out of the reach of a population that is disproportionately low-income, Black or Latino. The Fed says that 85% of white households are fully banked, but only 55% of Black families and 66% of Latino families are.

In her paper, Omarova cited the “unacceptably high human cost of being ‘unbanked’ in the United States,” which has included delays in receiving COVID-19 relief checks from the government, excessive fees charged by nonbank firms, and exclusions from credit.

She pointed to the implicit subsidy that taxpayers give banks for savings, which she argued has been “a crucial driver of the unprecedented consolidation and concentration in the U.S. financial industry since the 1990.”

That trend, she properly observed, morphed into the “too big to fail” phenomenon that tied the hands of financial regulators trying to deal with the last recession.

On the asset side of the banking ledger, Omarova has made the case for a so-called National Investment Authority that would manage public financing of socially beneficial investments, such as in green energy, other programs aimed at combating global warming, and in physical infrastructure.

As Omarova observed in her white paper on the subject, U.S. investment in clean energy has been “hovering around $56 billion annually,” or about one-tenth of what it should be for the U.S. to shoulder its part of the responsibility for fighting global warming.

The National Investment Authority, she wrote optimistically, would “help to solve the climate crisis, create well-paying domestic jobs, enhance the resiliency and productivity of the American economy, and systematically translate the vision of a clean future into tangible socio-economic and political change.”

Corporate America and conservatives consider the very idea of the government’s deciding what to fund and what not to fund iniquitous. Sen. Mike Rounds (R-S.D.) grilled Omarova on her argument, expressed in both “The People’s Ledger” and the National Investment Authority paper, that the government should withhold funding from socially “suboptimal” activities. He demanded that she give examples.

Easy question. Omarova noted that Congress constantly outlaws some banking activities that could theoretically be described as legitimate business dealings, such as money laundering and terrorist financing, because they are deemed to be socially inimical and thus, yes, suboptimal.

Implicit in her proposals is the obvious fact that the government regularly steps in to finance projects that private enterprise considers unprofitable to build, such as roads, bridges, Hoover Dam and the like. Private enterprise is happy to take advantage of and collect profits from these projects, once they’re built by taxpayers.

Omarova explicitly linked her idea for a National Investment Authority to the example of the Reconstruction Finance Corp., a 1930s-era agency that made government loans to banks and railroads to keep them afloat as the Depression took hold.

Wall Street Journal editorial writers have endorsed the claim that the National Investment Authority is part of her “socialist manifesto”; perhaps they’re unaware that the RFC, her model, was conceived and created by Herbert Hoover, the historical figure least likely to be mistaken for a radical socialist, during his presidency in 1932.

Left unexamined in the GOP’s effort to brand Omarova as a communist mole is that as comptroller of the currency, Omarova wouldn’t have the authority to implement any of these ideas on her own — the comptroller doesn’t have any say over the Fed, for example. Her role would be to ensure that the banks under her jurisdiction, meaning any institutions with a federal charter, operate safely and soundly.

Omarova‘s one viewpoint that might work into that portfolio is her skepticism about cryptocurrency investments, which she considers potentially destabilizing to the economy and believes could be used to circumvent consumer protections.

In her Senate testimony, she described her role as working with bankers to make sure that “our banking system really channels credit into the productive enterprise, meaning non-speculative actual businesses.” That sounds like a warning shot across the bow of crypto, which is the very definition of a speculative instrument.

Anyway, Omarova made clear that it isn’t up to her to decide what’s optimal and suboptimal as a government or indeed a bank’s investment portfolio — it’s up to Congress.

The Republican position that Omarova is somehow disqualified to serve as comptroller must be some sort of a gag, considering the parade of conflicted timeservers and incompetents who were routinely confirmed by a Republican Senate under Donald Trump — a Health and Human Services secretary from the drug industry, a farm- and water-industry lobbyist as Interior secretary, a union-busting lawyer as Labor secretary, etc., etc.

By contrast, the nervousness of the banking industry about Saule Omarova is the strongest recommendation for her confirmation. Who’s in charge of this process, anyway? The public servants elected to the Senate, or the banks that she’ll be forcing to behave?

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.