Brendan Goad is just the kind of customer Dave Inc. is looking for. Digitally savvy, trying to turn around his finances and, most important, short on cash.

The mental health peer-support counselor in St. Joseph, Mo., says he earns $20 an hour and sometimes can’t make it till payday, which means he’s suffered an indignity common in the U.S. banking system: $30-plus overdraft charges.

That was until he found Dave, a fast-growing West Hollywood financial app serving more than 6 million Americans in need of cash advances.

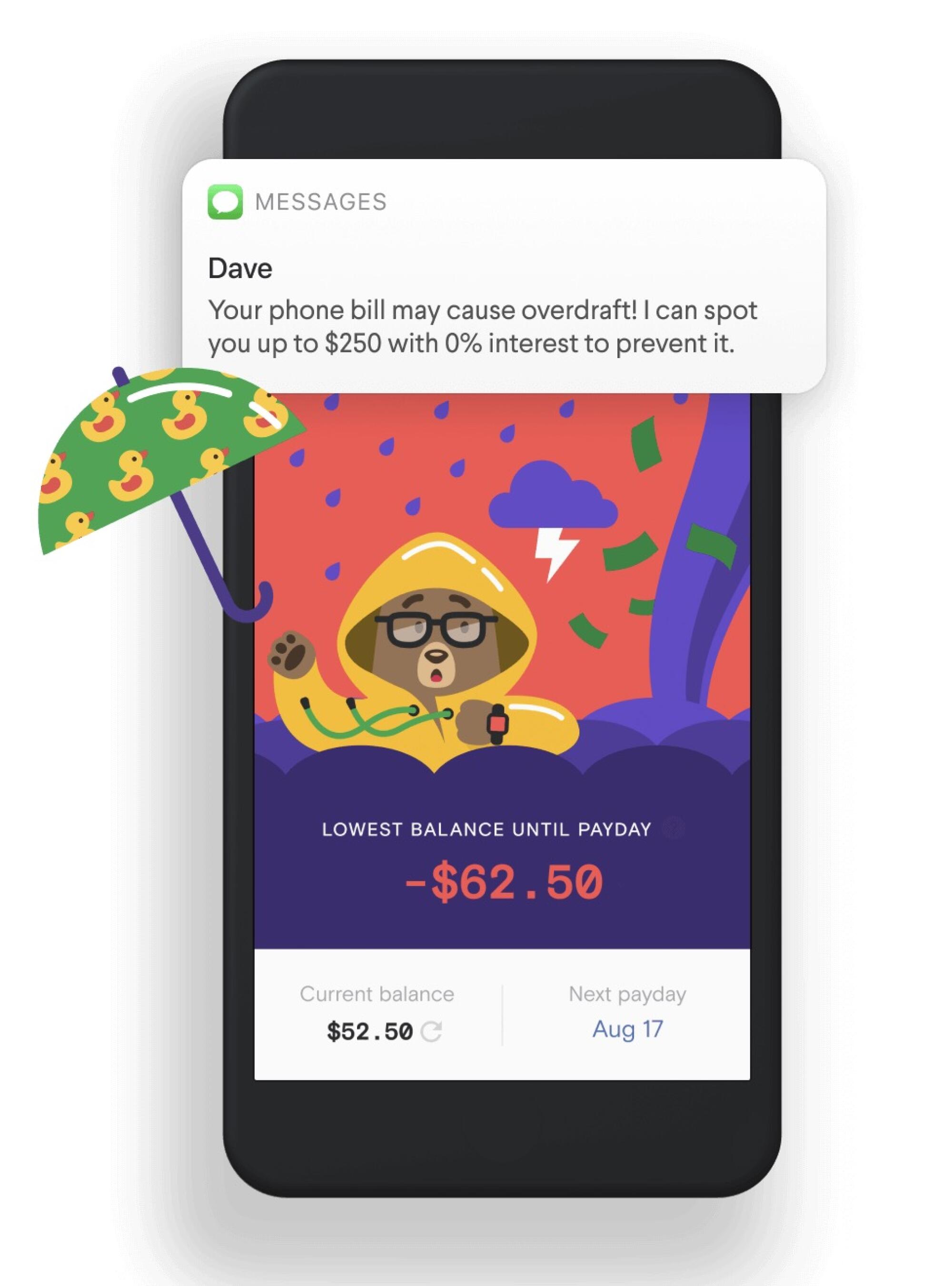

The come-on was nearly irresistible: The company promised a cash advance with no fees even without a credit check. “Start today and say goodbye to overdraft fees, good riddance to hidden fees and hello to more of your money in your account,” proclaims literature sent to new customers.

“I’m like, ‘OK, I’m sure there’s some kind of a catch that they’re going to charge me. Right?’” says Goad, 32. But he figured: “I’ll just try and see what happens.’”

In fact, Dave is counting on its customers to pay for its services — or it wouldn’t have gone public this year with the backing of high-profile investors, such as billionaire Mark Cuban. That no-fee claim? It comes with an asterisk.

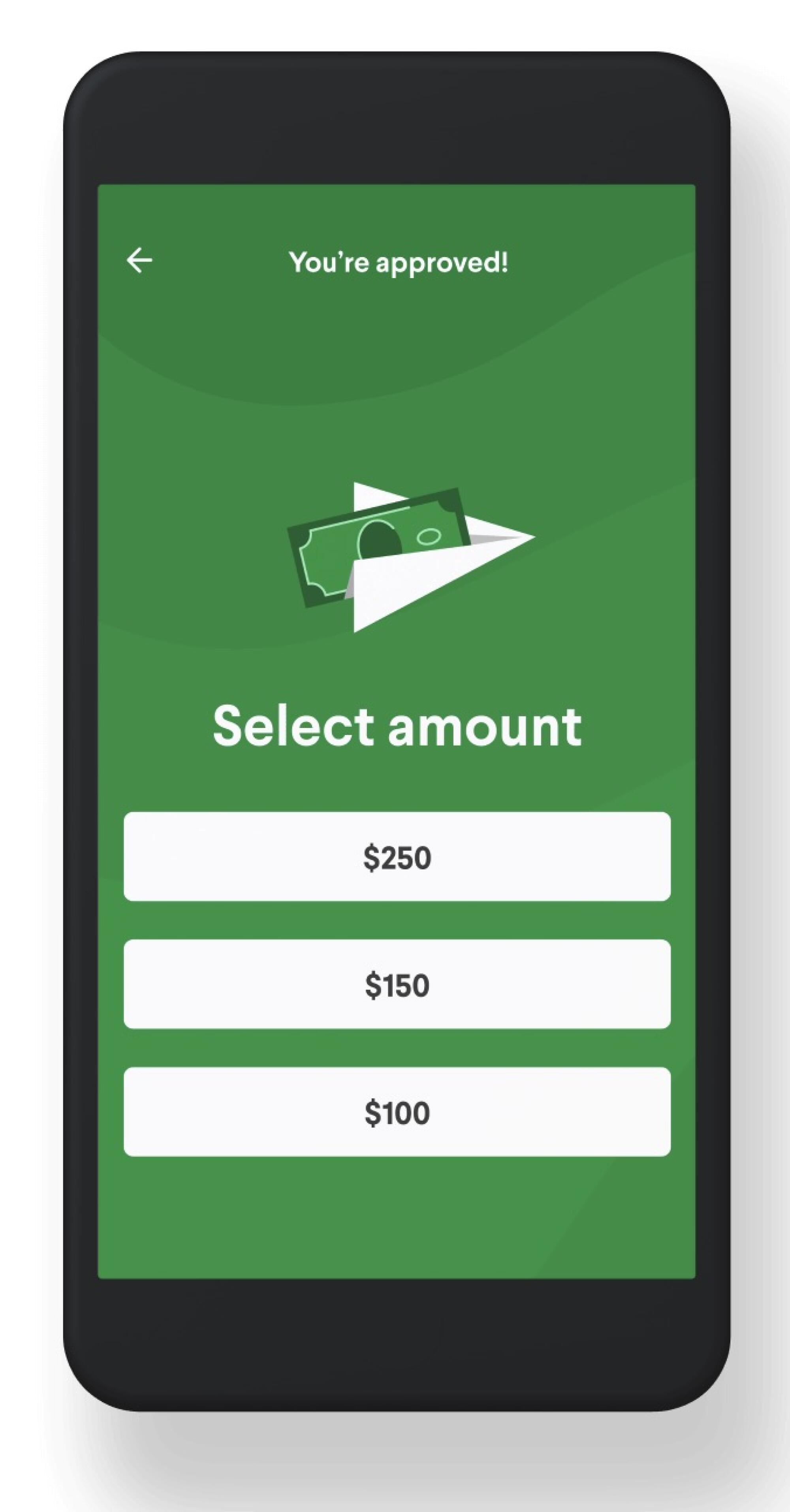

It starts with a $1 monthly membership fee. If you need a cash advance right away, as many do, there’s an “express fee,” which begins at $1.99 and tops out at $5.99 for advances of $100 or more. The money, typically repaid on payday, is truly free only if you can afford to wait a few days.

And would you mind, the app asks, throwing in a tip for our service?

Goad pays the premium to get his advances within hours and tips 1%. That’s well under the 15% tip the app described earlier this year as its “most popular” default option, but enough to make him feel like he’s contributing to the “community” Dave likes to celebrate.

Still, he figures the $7.99 in total he paid for a $200 advance in March was a deal compared with overdraft fees. And it’s cheaper than what a corner payday lender might charge. The average payday loan in the state was for $273, came with an interest rate of 414% and cost $43 if paid back in two weeks, according to a survey by Missouri regulators released last year.

Calculated another way, though, Dave’s advance is more expensive than it seems.

“The business was born to kill the expensive cost of overdrafts.”

— Jason Wilk, 36, co-founder of Dave

Given that the money had to be repaid in 12 days, the $5.99 fee and $2 tip, if considered as interest, cost Goad 122% on an annual percentage rate basis — a metric that helps compare the relative cost of loans. If he tipped $6.93, the company’s average in the first quarter, it would amount to an APR of nearly 200%. If he chose a 15% tip, the total cost would rise to $35.99 with an APR of 547% — corner payday loan territory.

Dave contends likening its advances to an interest-bearing loan is an apples-to-oranges comparison. The tips and express fees, it argues, are optional and flat, whereas interest is a mandatory charge that grows until a loan is repaid. In its annual report, it specifically describes its advances as 0% APR. In any case, Jason Wilk, the company’s chief executive and co-founder, says the fees are small.

“The business was born to kill the expensive cost of overdrafts,” says Wilk, 36, also the company’s chairman. “And maybe someone pays a few bucks for an instant fee. But compared to a $34 fee for as little as a $5 overdraft that’s crazy. You are talking about an APR calculation that’s 17,000%.”

As cryptocurrencies and NFTs gain popularity, addiction specialists are hearing from people whose compulsive trading resembles full-blown dependency.

Still, consumer advocates say the tips and what they consider to be inflated express fees charged by Dave and other startups that have entered the cash-advance business are disguised interest charges that obscure their true cost and should be disclosed under the half-century-old Truth in Lending Act.

And they don’t like how the apps want the cash back on payday, creating a hole in the next paycheck and potentially sending customers on a costly path of borrowing, paying back and reborrowing for what amounts to earlier access to their own wages — a so-called cycle of debt. Goad says at times last year he was taking out advances every pay period, juggling Dave and two other cash-advance apps.

In essence, critics view the apps as a spiffed-up version of established payday lenders, long derided for three-digit APRs and luring customers into debt traps. They are seeking to have the upstarts subject to strict licensing regulations to limit fees, potentially crimping their operations.

“Traditional payday loans and traditional overdraft fees are so awful that it’s not hard to be a little cheaper and a little better — and some of these [apps] may be,” says Lauren Saunders, associate director of the National Consumer Law Center. “But are they promoting people’s financial health? That is much more debatable.”

Paycheck to paycheck

The rise of cash-advance startups is a clear reaction to continuing sky-high overdraft fees charged by banks, which endure despite years of criticism from consumers, regulators and politicians — and recent moves by some banks to cut or eliminate them.

The average nonsufficient funds fee cost consumers a record $33.58 last year, according to Bankrate. And a recent Consumer Financial Protection Bureau study found that banks of all sizes continue to rely heavily on such fees, which brought them $15.5 billion in 2019 and particularly burden lower-income Americans.

That kind of gouging is how Dave found its niche. Wilk portrays the company to the media and Wall Street as a “champion” of the consumer. During Dave’s roadshow last year to drum up interest among institutional investors prior to going public, Wilk highlighted at one event that “there are still 150 million bank customers who are living paycheck to paycheck.”

In other words, lots of people need cash in a hurry.

Wilk grew up in the suburb of Agoura Hills and was a champion high school golfer. That won him a golf scholarship to L.A.’s Loyola Marymount University, where he displayed his entrepreneurial streak.

A business and technology major, Wilk started a company he ran from his laptop that peddled discount golf supplies. He sold the company for about $100,000 after graduation and traveled the world, not knowing what he would do when the money ran out.

He eventually decided to blog about startups and other tech topics, which secured him media credentials to a 2007 TechCrunch conference. That’s where he caught the eye of Cuban, an event speaker, after writing a post about how to get the billionaire to invest in your company.

Wilk kept in touch with Cuban and was later accepted into the famed Y Combinator business incubator in Silicon Valley with his coder friend Paras Chitrakar, who became a Dave co-founder. A plan to create a Twitter-based sports-betting company never panned out but the partners secured a $300,000 investment from Cuban that eventually helped build an ad platform called AllScreen. It was sold in 2015 for $85 million, with Cuban earning some $17 million on the deal.

“He is a learner, a grinder,” Cuban said in an email to The Times. “He was interested in running a profitable business — and I liked the ideas.”

Wilk says the Y Combinator experience and befriending Cuban, the Dallas Mavericks’ owner and “Shark Tank” regular, “was a life-changer.”

Wilk won’t say how much he earned in the AllScreen sale, but it left him and Chitrakar with enough cash to work on an idea that had been knocking around in his head — and would eventually become Dave.

A no-BS guide to buying your first home in Southern California.

Still smarting from his own experience with expensive overdrafts when he had little money, Wilk said his plan was to develop software that would analyze users’ bank statements and give them notice of upcoming payments. If they were short, the company would offer small advances until payday, when the app would pay itself back from users’ checking accounts.

It was a solution, Wilk figured, that was perfect for young people who wouldn’t think of going to a corner payday lender and instead would rather hit up a friend for cash. The name Dave, he says, represents the “everyday person” who “gets screwed over by all these overdraft fees.”

Wilk decided to offer the advances on a non-recourse basis, which means Dave can’t sue its users if the debts are not repaid, so it did not obtain state lending licenses.

After gathering up almost $3 million in a seed round that included Cuban and the family behind Kraft Foods, Dave went live on April 17, 2017. It was a rocky start. Customers soon realized they could sign up, get $250 and then just delete the app. “Money was flying out of the company. We didn’t anticipate the risk and the fraud associated with being so new in this space,” he says.

Dave scrambled to shut down its marketing and temporarily lowered the limit to $75 while it worked to improve its underwriting. Though the company does not do credit checks, it accesses customer banks accounts and uses machine learning to evaluate customers’ income and “transactional profile,” which it uses to evaluate whether to offer an advance and, if so, how much.

Once Dave improved that underwriting process and lowered its loan losses, Wilk says, the company grew like a “rocket ship.” (Trillions of dollars of government aid during the pandemic slowed growth, but revenue still increased about 25% last year to $153 million, though the company is unprofitable as it pours money into expanding services and its customer base.)

Cheerful avatars

For hundreds of years, banks have attempted to project an image of security through their imposing architecture and names such as JPMorgan Chase or City National Bank that reflect their institutional status.

The new wave of financial apps — at their core, software code — have none of those trappings. They often bear single-word names such as Mint and Digit that might suggest what they do or how you might feel when you use them. And they don’t just differ in name.

Dave is based in West Hollywood’s posh Pacific Design Center but has few employees there — or anywhere. Wilk told Wall Street investors last year, when it employed fewer than 200, that its headcount was less than “a handful of bank branches in L.A. or New York City.” Fewer employees means less overhead, but also less human interaction.

“I don’t mean to be a big supporter of banks, but they are more personal and your information is safer,” says attorney Tim Blood, who is representing Dave customers suing over a June 2020 data breach.

Dave has agreed to settle the proposed class-action lawsuit for $3.2 million despite what Blood calls the company’s strong arbitration clause — possibly, the attorney thinks, to avoid negative publicity. Dave won’t discuss the lawsuit, but banks too have been hit with large data breaches.

That less-than-personal touch has given ammunition to critics, who say deceptive interfaces and bogus promotions of “community” are used by cash-advance apps to persuade customers to tip the businesses as if they are Uber drivers.

“It’s a bad incentive structure that simply seeks to kind of shroud these fees and the actual cost of the service of the loan from consumers,” says Peter Smith, a senior researcher at the Center for Responsible Lending. “These are highly capitalized entities that are seeking to make money in a way that sometimes is fairly shrouded from the consumer.”

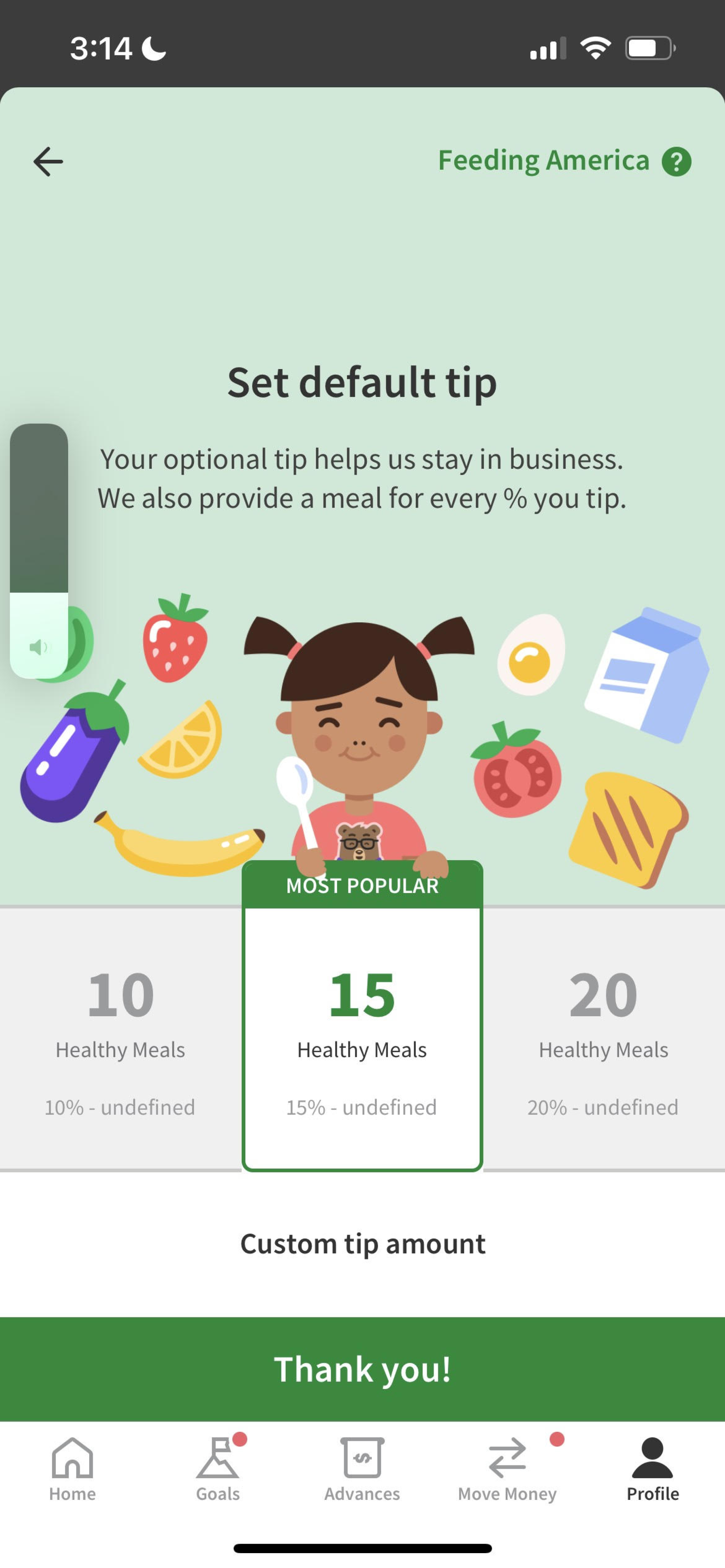

Dave does project a friendly face. After all, who wants to tip a bunch of ones and zeros? The app’s tagline is “Banking for Humans” and its icon is a cheerful spectacled bear. Earlier this year, The Times downloaded the Dave app, which asked the user to set up a default tip. A smiling cartoon-drawn girl held up a 15% tab labeled “most popular.”

Stephen Spiller, a marketing professor at the UCLA Anderson School of Management, says the company’s desire to receive tips is an attempt to expand a cultural tradition typically involving personal interactions.

“The relationship here is very different from what we expect to encounter when we’re tipping at restaurants or drivers or delivery people,” he says. “We don’t normally expect that as part of a financial services transaction. If you simply ask people, ‘Hey, do you want to pay us extra money for this?’ They will probably say no.”

Dave also tugs at customers’ social conscience. The app links higher tips to a greater number of meals for the poor through a partnership with the charity Feeding America — though the app interface also states tips “helps us stay in business.”

“The tips support the business. There’s the people that are building the business, the engineers, the product people, the designers — all that goes towards paying the payroll, so why can a tip not function the same way there as it is with a barista at Starbucks?”

— Jason Wilk, co-founder of Dave

Only a portion of tip revenue went to charitable contributions in the first quarter, according to a regulatory filing. Dave made $5.9 million in charitable contributions while earning $13.9 million in tips during the time period. Sixty-four percent of customers who got advances left tips, which averaged $6.93, according to the filing.

The company says that fewer than half of advances made are tipped, suggesting tipping is not consistent.

Some apps have been accused of limiting the advance amount based on the tip, practices critics call abusive. Wilk says Dave doesn’t do this and brushes off the criticism from consumer advocates.

“The tips support the business. There’s the people that are building the business, the engineers, the product people, the designers — all that goes towards paying the payroll, so why can a tip not function the same way there as it is with a barista at Starbucks?” he asks.

The express fees for speedy cash rankle consumer advocates too, especially since the apps typically advertise advances as free. “Of course, most people who are trying to get money want it now, and they will pay extra money to get the money today rather than wait a day or two,” Saunders of the National Consumer Law Center says. “Those fees can add up and it’s just another way of making money off you.”

The company reported that about 99% of customers who got advances paid the express fees in the first quarter, paying an average of $5.42 and earning Dave $21 million net of costs, according to a regulatory filing.

Tall cans of AriZona iced tea have cost 99 cents since 1992. The family behind the company says it’s committed to that price even as the prices of aluminum and corn syrup climb higher.

The company says that although virtually all customers who got advances paid express fees at one point during the time period, fewer paid every time they sought an advance. The company also cites a company survey that it says found only 20% of customers needed their money instantly, while others who paid the fee did so because the price was perceived as reasonable.

Wilk acknowledges the fee is a way to “monetize” the product but argues that express fees are similar to ATM fees — and could be largely avoided if customers took advantage of its $1 monthly expense-forecasting service, which alerts users about upcoming expenses.

He also dismisses the idea that Dave leads users into debt traps, saying the company advances only as much money as its underwriting shows users can pay back. “Our model is the most consumer-friendly possible,” he says.

“The reason challenger banks are winning is because it costs them from $10 to $20 to acquire a customer, which is 50 to 100 times less than it costs JPMorgan to acquire one.”

— Sean Horgan, a former analyst with Rosenblatt Securities

The company has an incentive to avoid overly large advances — it can lose money on them.

Automatically withdrawing the advance and any associated fees on payday could cause an overdraft if there aren’t sufficient funds in the account — the very problem Dave was founded to solve. Wilk said the company reimburses customers if it causes an overdraft, but did not provide a total.

It’s a real issue for the industry. A wage advance company called Earnin got into trouble by repeatedly trying to debit customer accounts that were negative. It settled a class-action lawsuit for $12.5 million last year.

Advances that aren’t repaid affect the bottom line in another way.

Dave set aside $13.8 million for unrecoverable advances in the first quarter, according to a regulatory filing, which described the rate as “steady.” In its fourth-quarter earnings call this year, an executive said loan write-offs have been about 2% of its cash-advance volume and associated revenue, evidence the company cites that it is not making advances to customers who can’t afford to pay them back.

Cost advantage

Wilk holds about 25% of Dave’s shares, according to a spokesperson, which, given the company’s market cap, is worth more than $200 million. He also controls about 60% of the voting stock through the kind of dual-share structure that has allowed Mark Zuckerberg to stay atop Facebook despite repeated crises. Under Wilk’s leadership, Dave has been one of the nation’s fastest-growing companies.

But with $132 billion in venture capital invested worldwide last year in fintech startups — twice as much as in the prior year, according to data analytics firm CB Insights — the competition is stiffening.

In the cash-advance business, Dave has rivals such as MoneyLion and Albert, while online banks including Chime have gotten into the field. There are also companies that work directly with employers to offer earned-wage advances such as PayActiv and FinFit, some that charge and some that don’t, the latter of which consumer advocates have fewer qualms about.

The opportunity for the nimble upstarts is huge. Traditional banks spend a lot on bricks-and-mortar headquarters and branches, making it tough to compete, even as customers are becoming more comfortable banking online and on their phones.

“The reason challenger banks are winning is because it costs them from $10 to $20 to acquire a customer, which is 50 to 100 times less than it costs JPMorgan to acquire one,” says Sean Horgan, an analyst with Rosenblatt Securities until he took a job this month with MoneyLion.

“And it’s becoming less and less important for especially younger generations to have a physical bank branch, but it’s not very popular to close down a bunch of branches and fire a bunch of people,” he says.

With banks hamstrung like that, Wilk is focused on expanding Dave’s services so it becomes his customers’ primary banking partner, making it what’s called a “neobank.” Two years ago, in partnership with a bank, it began offering a free digital checking account that comes with a debit card, which earns the company a share of transaction fees paid by merchants and out-of-network ATM fees.

“We don’t believe it’s about whether or not to regulate these products, the question is how to do it.”

— Suzanne Martindale, senior deputy commissioner, California Department of Financial Protection and Innovation

More than 2 million customers, the company says, have signed up for the account, which has incentives. Direct deposit a paycheck and the funds are available two days early. It also comes with a year of free credit-building service.

The company is rolling out a savings account and after that a Venmo-type product that will allow customers to send and receive cash from friends and family.

And now that the company has gone public, it has talked about spending some of the proceeds on acquisitions. It also recently received a $100-million investment from the FTX cryptocurrency exchange and plans to start offering a crypto product.

The potential for growth looks bright — but critics want to put on the brakes. Consumer advocates want tips and “inflated” express fees to be considered finance charges and subject to interest rate disclosures and usury laws that cap interest rates.

Traditional payday loans, by comparison, are banned in 18 states and subject to both federal and varying state rules in others involving interest rates, the number of times borrowers can roll over the loans and repayment options, with critics pressing for more reforms.

Wilk is adamant that the company does not need to be licensed as a lender since its advances are non-recourse and fees optional, including the membership fee. The company also says it doesn’t charge late fees, report nonpaying customers to credit bureaus or sell any of its bad debt to collectors — common practices of old-school bricks-and-mortar payday lenders.

That assertion is being put to the test.

In their own words, former Tesla employees describe what they call a racist work environment that led California to file a civil rights lawsuit against the company.

There’s a multi-state investigation led by New York into whether payroll-advance apps are engaging in illegal online lending, including disguising interest rates as tips and violating usury laws, which cap interest rates. And in November, a U.S. House Task Force on Financial Technology held a hearing that took testimony from the industry and consumer advocates on cash-advance apps and other emerging lending platforms.

Dave, itself, has been the subject of a Consumer Financial Protection Bureau probe. The agency informed Dave in September “that it currently did not intend to recommend that the CFPB take any enforcement action,” according to a regulatory filing.

But President Biden’s CFPB chief, Rohit Chopra, has signaled he plans to scrutinize the fintech industry. In January, the agency separately announced that it was conducting a review of what it called consumer “junk fees.” It specifically cited bank overdraft charges in asking for comment. Consumer advocates submitted a critical report on a variety of fintech practices, which described tips and express charges as junk fees.

Meanwhile, California’s new Department of Financial Protection and Innovation is gathering consumer data from Dave and other cash- and wage-advance companies that could lead to licensing and other restrictions.

“We don’t believe it’s about whether or not to regulate these products, the question is how to do it,” says Suzanne Martindale, a senior deputy commissioner — who thinks new regulation won’t solve everything in a country where almost half of households have trouble meeting expenses.

“They need more cash. And the question is, what form does that cash come in?” she says. “I think some of the solutions are going to fall outside of our jurisdiction. It’s going to be a living wage, it’s going to be affordable housing, it’s going to be some other stuff.”

Consumer advocates say a better alternative is small-dollar installment loans from employers or banks that customers can pay back over time, instead of in lump sums. Some banks have started to offer the loans but it has yet to catch on big.

Wilk says he’s “a fan of regulatory oversight” to weed out the industry’s bad actors, such as those that limit credit based on tips. But he says that caps on tips or express fees would only mean less revenue and fewer advances. He points to the firm’s 4.8 rating in the Apple App Store as proof of his customers’ satisfaction.

“Right now we’re going to approve 90% of people because there is some favorable economics around tips and express fees to make that work for so many people,” he says. “So if you restrict the margin you can make there that just means helping less people.”

Cuban says the reality is that Dave exists because it “fills a need” as banks charge “predatory” overdraft fees. He also proclaims faith in the company and its stock, saying he has “not sold a share and [has] no plans to do so.” Since February, when it hit a high of $15.35, Dave’s stock is off more than 80% amid the tech rout, according to FactSet. It closed Tuesday at $2.61.

The heady days of growth could slow though. A paper by the Pew Charitable Trusts called January of this year a “watershed month for boosting consumer protections” as five large banks announced overdraft reforms. Still, many banks still charge fees topping $30, including Chase and U.S. Bank.

“People are excited by technology — to solve some of the problems in a really difficult financial climate. Unfortunately, I don’t think it’s that simple,” said Smith of the Center for Responsible Lending.

Goad, the mental health peer-support counselor, wasn’t aware of how much Dave’s advances cost when considered on an annual percentage rate basis.

He had already been trying to cut back on using cash-advance apps before he got sick in March and got jammed up with bills. He now has a Dave savings account set up to build his own financial cushion and be less dependent on advances.

“I don’t think I will stop using Dave, but I’m going to be more conservative in how often I use it,” says Goad, who noted that another thing that would really help his financial problems is a raise.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.