Column: The stupid and dishonest idea of raising the Social Security retirement age is back

The people who are in the forefront of pushing Social Security “reform” by cutting benefits have gotten pretty good at hiding their intentions behind plausible-sounding jargon and economists’ gibberish.

The latest “reform” package offered by the Committee for a Responsible Federal Budget, for example, calls on lawmakers to “promote stronger economic growth and productive aging” by removing “work and savings disincentives in the current program.”

“Productive aging” — that’s a good one. Sounds reasonable while being utterly vacuous. Monique Morrissey of the Economic Policy Institute provides a concise translation: “Raise the retirement age.”

A smaller share of older Americans work today than half a century [ago], even as life expectancy has risen dramatically.

— Committee for a Responsible Federal Budget

It may not be surprising that the CRFB, a Washington think tank that was heavily funded by the late private equity billionaire Pete Peterson, might want to hide its prescription behind a curtain.

Raising the retirement age is best described as a zombie reform plan. Despite being debunked repeatedly as a benefit cut that falls disproportionately on low-income and Black workers, it still walks among us.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Indeed, the idea has been getting a renewed airing, despite the evidence that it’s a worse idea now than ever.

Joseph Chamie, a former demographer for the United Nations, proposed in a November article for the Hill raising the retirement age to 70 and eliminating the early retirement option, through which workers can start claiming Social Security benefits starting at age 62, with a reduction in lifetime benefits for each year before their normal retirement age. (For those born in 1960 or later, that’s age 67.)

Revealing that, whatever he may know about demographics, he knows almost nothing about Social Security, Chamie asserted that his proposal “could save Social Security for us all.” He managed to make that claim without mentioning any other proposals to shore up the program’s finances, especially raising or eliminating the cap on payroll taxes, a cap that effectively gives the rich a free pass on supporting the program.

The retirement age panacea has been heard beyond these shores. French President Emmanuel Macron has proposed raising that country’s minimum retirement age to 64 from 62. The proposal has sent unionized workers into the streets and prompted other forms of protest.

And that’s in a country where the anti-poverty safety net is vastly better than in the United States: About 4.4% of French retirees older than 65 live in poverty, compared with 10.3% in the United States.

The omnibus bill signed by President Biden will make it easier for many people to save for retirement, but more help is needed

Now let’s take a closer look at the CRFB’s proposal, embodied in a Jan. 30 white paper titled “Principles for Social Security Reform,” which is itself based on a CRFB paper published in 2019.

In that paper, the “productive aging” trope was explicitly tied to an increase in both the full retirement and early retirement ages — to 68 and 63, respectively, with further increases averaging one year every quarter-century or so.

In both versions, the retirement age increase is based on the assumption that older workers would continue to work, perhaps till they dropped, if not for the “mixed retirement signals that often draw them into early retirement and treat retirement itself as a binary choice.” That implies that workers are almost duped into filing for Social Security, when they would be so much happier staying on the job.

The CRFB wrings its collective hands over its discovery that “a smaller share of older Americans work today than half a century [ago], even as life expectancy has risen dramatically and the nature of employment and technology has made it easier to work at older ages.”

This is a remarkably blinkered view of Americans’ work experience. Retiring in one’s 60s is a sign of the improved quality of life available to workers today compared with those of 50 years ago, not a sign of laziness or irresponsibility.

As for whether it’s “easier” to work into one’s 70s than it used to be, that may be true for authors of think tank papers in air conditioned offices, but perhaps not for the millions of Americans who spent their careers hauling, digging, driving and building, outside in the elements.

Underlying the proposals to raise the retirement age is the wholly false notion that life expectancy is increasing for all Americans at an inexorable rate. The reasoning is that the drafters of Social Security in 1935 never expected people to live this long, so they failed to provide for the increase in costs that would be the result.

The only suitable countermove, ostensibly, is to raise the retirement age to pare back the years that the average retiree will be collecting benefits.

Former Sen. Alan Simpson worked to undermine Social Security. Why is he getting a Presidential Medal of Freedom?

We’ve explained over and over again that this picture of life expectancy is distorted. The CRFB’s 2019 paper says that “life expectancy has risen dramatically,” but that all depends. For example, it’s true that average life expectancy from birth rose by more than 15 years between the 1930s and 2020, to nearly 79.

Most of that increase occurred because of reductions in infant mortality. The more relevant measure is life expectancy from age 65, which tracks the average length of retirement and Social Security collecting. There the picture isn’t quite as cheery. It’s also one in which demographics are an important factor.

For all Americans, average life expectancy at age 65 has risen since the 1930s by about 6.6 years, to about 84 and a half. The increase has been about the same for white workers. But for Black people in general, the gain is just over five years, to an average of a bit over 83, and for Black men it’s less than four years and two months, to an average of about 81 and four months.

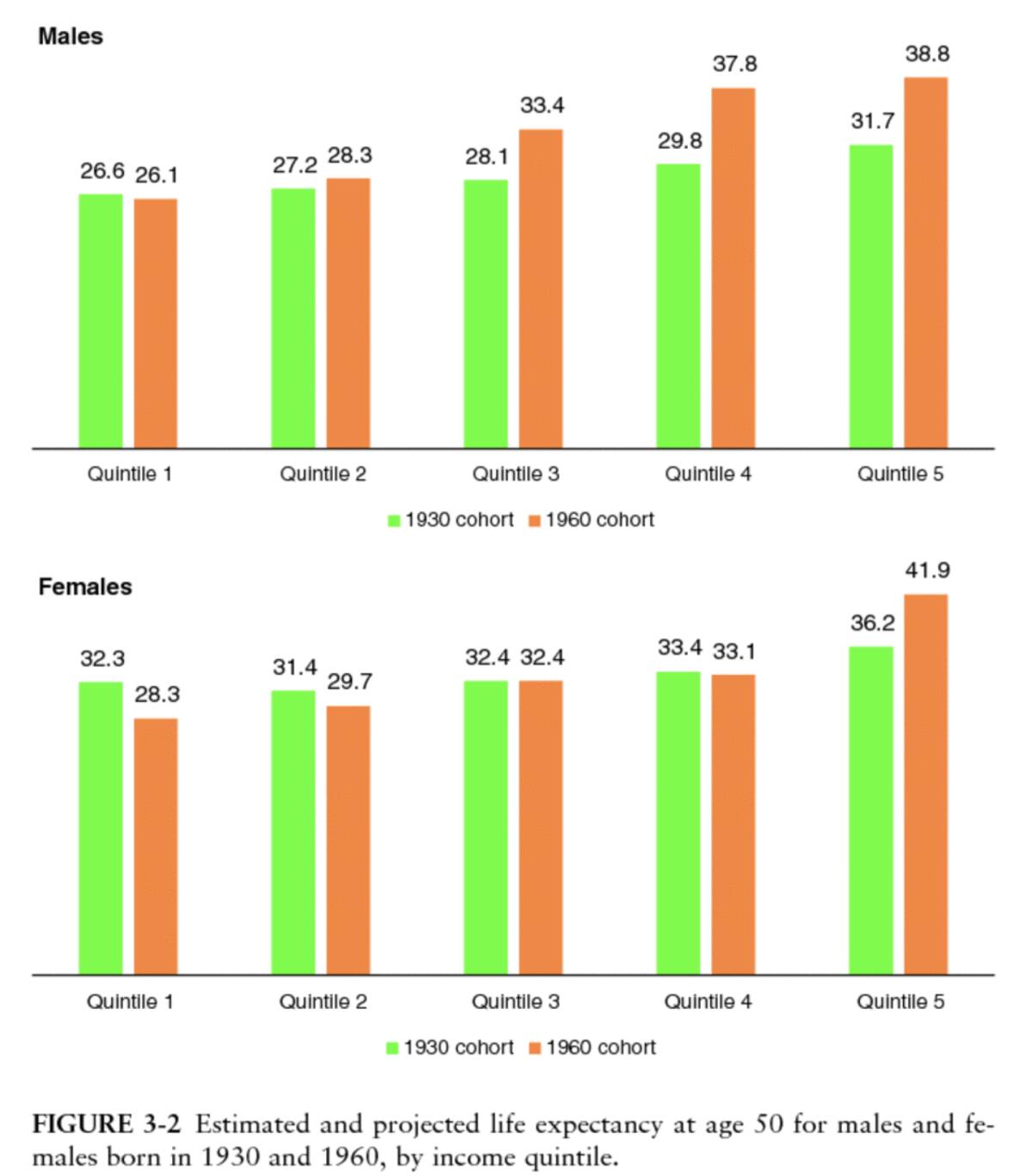

That’s not all. There are also pronounced disparities in life expectancy by income. The CRFB waves away this issue: “Raising the retirement ages does not — as some claim — disproportionately affect lower earners or regressively cut benefits,” its 2019 paper asserted.

Who claimed this? The Congressional Budget Office and National Academy of Sciences, to name two sources that painstakingly documented the disproportion.

Finally, there’s the discomfiting fact that American life expectancy has not been rising inexorably. Rather, it’s been dropping. The average life expectancy from birth fell to just over 76 in 2021 from nearly 79 in 2019, the sharpest fall in a two-year span since before the Great Depression.

The fall is generally blamed on the drug overdose crisis and COVID-19, which suggests that another decline is likely to be found in 2022. But there’s no waving away the implications — drugs and COVID are inescapable features of life today.

Social Security “reformers” always tend to forget the realities faced by the vast majority of American workers. The program was created to give them a shot at a secure retirement after a lifetime of what may have been backbreaking work. The advocates of raising the retirement age want to take it away.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.