Should extra cash go to retirement or emergency savings?

Dear Liz: I have an excessive amount of money in my bank checking and savings account (about $20,000 in each) and need to know where to invest it. My financial planner advised putting it in my 401(k), but I can’t transfer a chunk of money, I can only increase the percentage I contribute (which is currently at 10% of my salary). I have IRAs, but I can only deposit a certain amount there as well. Where would be the best place for this extra money to go that will pay interest?

Answer: You may not be able to put the money directly into your 401(k), but you could boost your contribution rate at work and tap the “excess” money in your accounts to make up the difference in your paychecks.

First, though, make sure you have an adequate emergency fund. Most financial planners recommend keeping a reserve equal to three to six months’ worth of expenses. This money should be kept in a safe, liquid account, such as an FDIC-insured bank account. You don’t need to settle for the tiny amount of interest many banks pay, however. Some online high-yield savings accounts are now paying over 4%.

When Social Security isn’t enough

Dear Liz: I am 87, divorced for 45 years, never remarried. I applied for my 93-year-old former husband’s Social Security support and qualified. I was refused by the local Social Security office. I really don’t understand why. I am a COVID long-hauler and I get confused. I was a stay-at-home mom until my kids were in college, and my husband divorced me. My Social Security is not enough to support me, and I am seriously in debt. I am set up with Social Security to receive my share of my former husband’s Social Security at the time of his death. What am I doing wrong?

People may be eligible for benefits from ex-spouses’ work records if the marriage lasted at least 10 years. The rules are complex. Here’s a primer.

Answer: If your former husband is still alive, it’s possible that your current Social Security retirement benefit is larger than any benefit you would have gotten from his work record. Spousal and divorced spousal benefits are limited to 50% of the primary worker’s benefit at full retirement age.

Should he die, you could be eligible for a divorced survivor benefit, which is up to 100% of the amount he was receiving.

Rather than wait, though, you should consider talking to a bankruptcy attorney about your debt. Consider asking one of your kids or a financially savvy friend to come with you and take notes so you understand your options.

Caught in the IRS backlog

Dear Liz: In 2021, we helped two of our children buy a condo. One of them confessed she hadn’t filed taxes for several years. We worked on the returns together, and it turned out that nothing was owed. Meanwhile, the IRS has never acknowledged the delayed tax filings or refunded the (small) overpayments. Shouldn’t the IRS have completed these filings by now?

Answer: The IRS says it has processed all paper and electronic individual returns for tax year 2021 or earlier if those returns had no errors or did not require further review. Returns that were filed late, however, may still be part of the agency’s backlog.

Your child can try using the “Where’s My Refund?” tool on the IRS site or create an online account to check for possible updates. Keep in mind that there’s a three-year limit to claim a refund; after that point, the U.S. Treasury gets to keep the money.

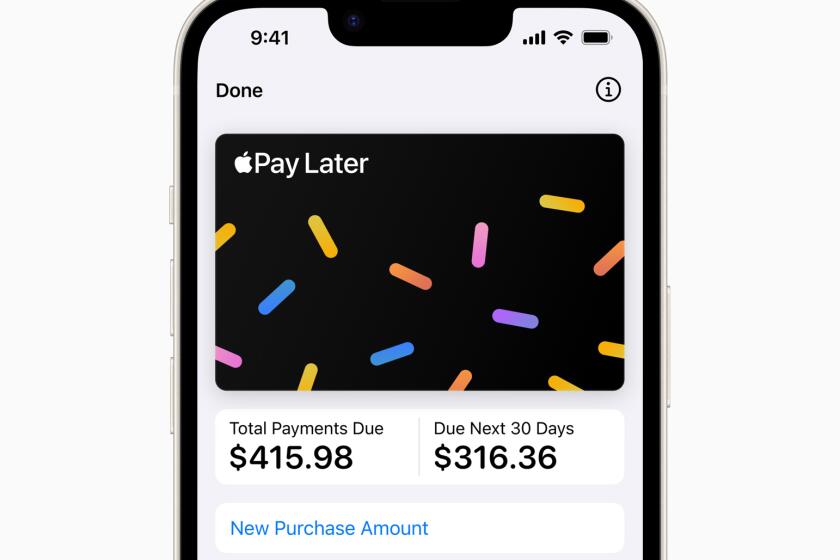

Apple announced Apple Pay Later, the latest entrant in the increasingly crowded “buy now, pay later” space. Is it “free money”? Not quite. Here’s what personal finance experts say.

Finding free tax help

Dear Liz: You recently mentioned the AARP Foundation Tax-Aide Program as a resource for getting help with tax returns. I just want to point out that there are other, IRS-sponsored programs that provide free income tax assistance to the elderly and low-income taxpayers. These programs are Volunteer Income Tax Assistance (VITA) and Tax Consulting for the Elderly (TCE). The site where I’ve volunteered for many years does approximately 2,000 tax returns each year. A mention in your column would be a great way to spread the word about this valuable service.

Answer: Consider it done. The IRS has a tool to find VITA and TCE resources using your ZIP Code.

Liz Weston, Certified Financial Planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.