Why those great deals banks are offering might be less lucrative than they appear

Dear Liz: I’m receiving numerous email offers from big banks offering significant incentives and bonuses to open checking and savings accounts. I usually don’t pay much attention to them but the latest one is offering $900 to open these accounts. I’ve read all the fine print and understand all the requirements, but I can’t help but think there is a mischievous motive on their part. How do I decide if these offers are a good financial alternative for me?

Answer: Banks offer these incentives to lure in new customers, but you’re wise to consider all the potential costs because the bonuses may be less lucrative than they appear.

For starters, you’ll pay income taxes on any sign-up bonus, which could substantially reduce what you net from the deal. Plus, many banks that offer sign-up incentives pay a paltry interest rate or no interest at all. You could be better off putting your money in a high-yield savings account. (Some online banks are paying around 5%.)

You typically must maintain a certain balance to avoid monthly account fees, and you may need to set up a direct deposit or make a set number of transactions per month as well. The bonus often isn’t paid until after your account has been open 90 days or more. If you close the account, you may face an account closure fee.

The 50/30/20 budget was popularized by Sen. Elizabeth Warren and her daughter Amelia Warren Tyagi in their book, “All Your Worth: The Ultimate Lifetime Money Plan.”

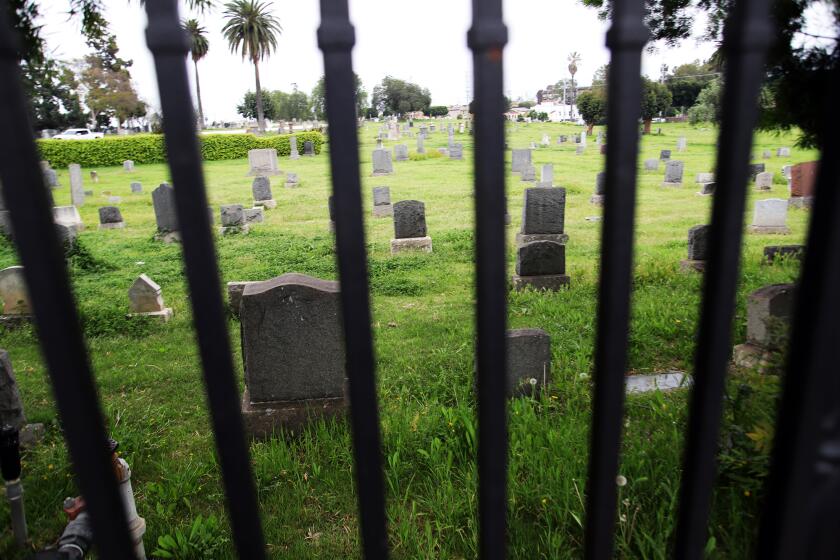

Watch out for probate triggers

Dear Liz: My wife and I have a living trust that includes most of our assets. We have two bank accounts that are not in the trust totaling $130,000. Will these accounts be subject to probate? If it matters, she is in memory care and I handle all finances. Our executor son is a signer on one bank account to have ready access to cover final expenses in case I predecease my wife.

Answer: As you know, living trusts are designed to avoid probate, the court process that otherwise follows death to distribute someone’s estate. In some states, including California, probate can be expensive, prolonged and often worth avoiding. Assets typically must be titled in the name of the living trust or have a designated beneficiary to avoid probate. There are some exceptions, but you’d be smart to consult an estate planning attorney to make sure you don’t inadvertently trigger the probate you’re trying to avoid.

The lack of a will generally means no inheritance for an unmarried life partner. But in California, longtime partners might be able to use the ‘Marvin rule.’

What’s a qualified charitable distribution?

Dear Liz: I have a suggestion for the couple who is facing the start of required minimum distributions from their retirement accounts but who do not need the money. They could consider making a qualified charitable distribution (QCD). A QCD allows you to donate to a charity directly from your IRA and satisfies your RMD requirement. The only caveat is that the money cannot pass through your hands. It must go directly from the IRA to the charity. You can’t take a deduction for the contribution, but the money won’t count as taxable income. Although the age of RMD has been rising in recent years, the age for a QCD remains at 70½. The maximum allowable is $100,000 per taxpayer a year. A husband and wife can each make a QCD if they have separate IRAs.

Answer: Qualified charitable distributions can be a great solution for people who have saved more in their retirement accounts than they need and who want to benefit good causes. The charity must be a 501(c)(3) organization that can receive tax-deductible contributions, and, as you note, the money needs to be transferred directly from the retirement account and the contribution made before the year’s RMD deadline, which is typically Dec. 31. There are a few other rules involved, so consider consulting a tax pro before arranging a QCD.

Liz Weston, Certified Financial Planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.