Column: Trump’s media company is going public, netting him billions. Why would anyone invest in it?

The headline Trump news on Friday was that investors in Truth Social, his money-losing social media platform, voted to take it public at a valuation that could net the former president about $3 billion.

There’s some press conjecture that the transaction will relieve Trump’s current cash crunch, which includes the necessity of his posting a bond to cover a roughly $500-million court judgment by Monday to stave off the seizure of some of his properties by New York Atty. Gen. Letitia James. That speculation is probably, though not certainly, wrong.

From a financial standpoint, the primary questions are: Should you believe that figure? And, would anyone in their right mind invest in this thing?

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

My back-of-the-envelope judgments are: Probably not, and probably not. This is not investment advice, but, really?

Let’s take a closer look.

Truth Social will go public via a merger with a special purpose acquisition company, or SPAC, called Digital World Acquisition Co. The merger was approved by investors in DWAC on Friday.

That arrangement comes to fruition despite several questionable aspects of the transaction. SPACs are supposed to come into existence (via an initial public offering) without any prearranged acquisition deals, but rather to hunt them down within a set period, normally within two years of their formation.

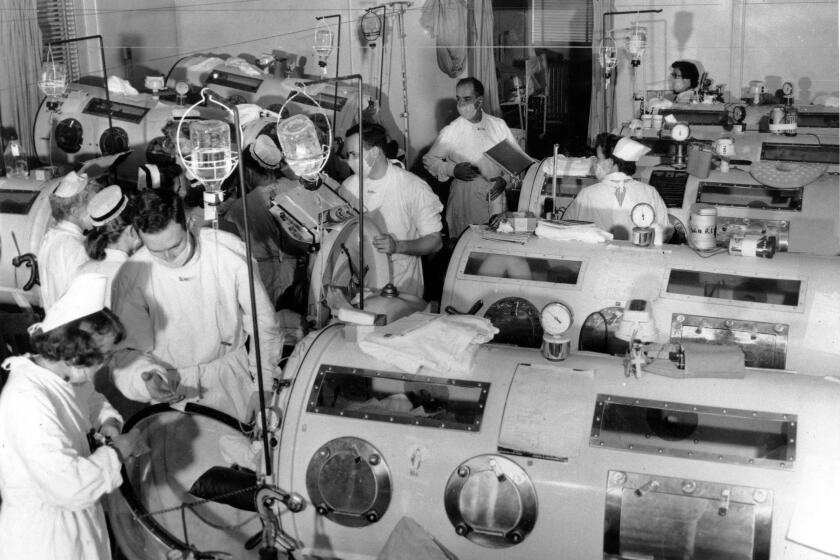

Trump and Robert F. Kennedy issued attacks on child vaccinations, including for polio, last week. They want to return us to the 1950s, when preventable diseases struck millions of Americans.

The Securities and Exchange Commission, however, charged in July that DWAC had “formulated a plan to acquire and was pursuing the acquisition of TMTG” prior to its own IPO, and failed to disclose that to investors. (TMTG is Trump Media and Technology Group, the parent of Truth Social.) DWAC settled the SEC case for $18 million.

It should be noted that SPACs in general don’t have the best reputation in the corridors of the SEC, because they could be used to execute initial public offerings without making the customary pre-IPO disclosures to investors.

The Trump deal, which has been percolating for more than two years, looked from the first like a potential high-water mark for SPAC-related investment scams, as I wrote in 2021.

The merged entity is expected to be priced at a valuation of about $5 billion. As 60% owner of the entity, Trump would stand to own about $3 billion in shares.

It should be plain that the valuation has no rational relationship with Truth Social’s financial picture, which is ugly in the extreme.

In a prospectus issued last month, DWAC disclosed that Truth Social collected a mere $3.4 million in revenue during the first nine months of 2023 and booked a loss for that period of $49 million.

The $5-billion estimate of the merged company’s value derives from the interest being shown mostly by small investors enthralled by the likely Republican presidential candidate as a political figure and celebrity.

That places Truth Social in the category of a “meme stock,” similar to GameStop, which reached a stratospheric valuation in January 2021 because credulous retail investors thought they were striking a blow against short sellers and hedge funds by driving up the market value of a company that had little genuine value as a mall-centered seller of video games.

GameStop’s share price peaked at more than $500, or about $125 split-adjusted. It has lost 90% of its value since then. In other words, you shouldn’t expect Truth Social’s market value to be related much to its revenues or profits but on the public standing of Donald Trump. As Mark Twain wrote in Huckleberry Finn, “You pays your money and you takes your choice.”

As for how Trump can use the proceeds of Truth Social as a public company, the prospectus states that Trump and other principals agreed to a six-month lockup of their shares, meaning he couldn’t sell them or borrow against them until mid-September at the earliest. That means he wouldn’t be able to use them to cover the judgment against which James may start acting as early as Monday.

But there’s an escape clause written into the deal: Trump can seek a waiver of the lockup from the post-merger board. How likely would that be?

Kristen Welker got steamrollered by Trump, showing that she and the ‘Meet the Press’ team were unprepared for a crucial encounter.

Pretty likely, I’d guess. Of the 12 people Trump has nominated for the post-merger board, at least seven have personal ties to him. They are: Devin Nunes, who as a Republican congressman from California was an embarrassingly sedulous supporter of Trump, and who left Congress in January 2022 to become chief executive of Truth Social; Trump’s son Donald Jr.; Kash Patel, a former aide to Nunes and a member of Trump’s executive branch entourage; Scott Glabe, a former aide to Trump in the White House and Trump’s appointee to an important post at the Department of Homeland Security; Robert Lighthizer, U.S. trade representative under Trump; and Linda McMahon, the former CEO of World Wrestling Entertainment who became chair of America First Action, a Trump-associated super PAC, and is now chair of America First Policy Institute, a think tank devoted to Trump policies.

What are the chances that they would vote to thwart Trump’s need to turn his shares into cash? You be the judge. Keep in mind that any large-scale sale of Trump’s shares would probably crater the stock price and take his unwary investors to the stock market woodshed.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.