Want to understand the state of streaming churn? Here are four charts to help

This is the April 5, 2022, edition of the Wide Shot newsletter about the business of entertainment. If this was forwarded to you, sign up here to get it in your inbox.

After a long wait, “Halo” is finally a TV show. The adaptation of the successful video game franchise debuted March 24 on Paramount+ and became the streamer’s most watched premiere, topping “Yellowstone” prequel “1883,” according to the company.

Cool, says the streaming data nerd.

But how long will those viewers keep paying for Paramount+ after signing up to watch the adventures of super-soldier Master Chief? Is there enough other material on the service to keep fans interested after the show runs its course?

This is a key question for companies that are trying to compete in a crowded market of streaming services, each of which is spending billions of dollars a year on programming to attract subscribers.

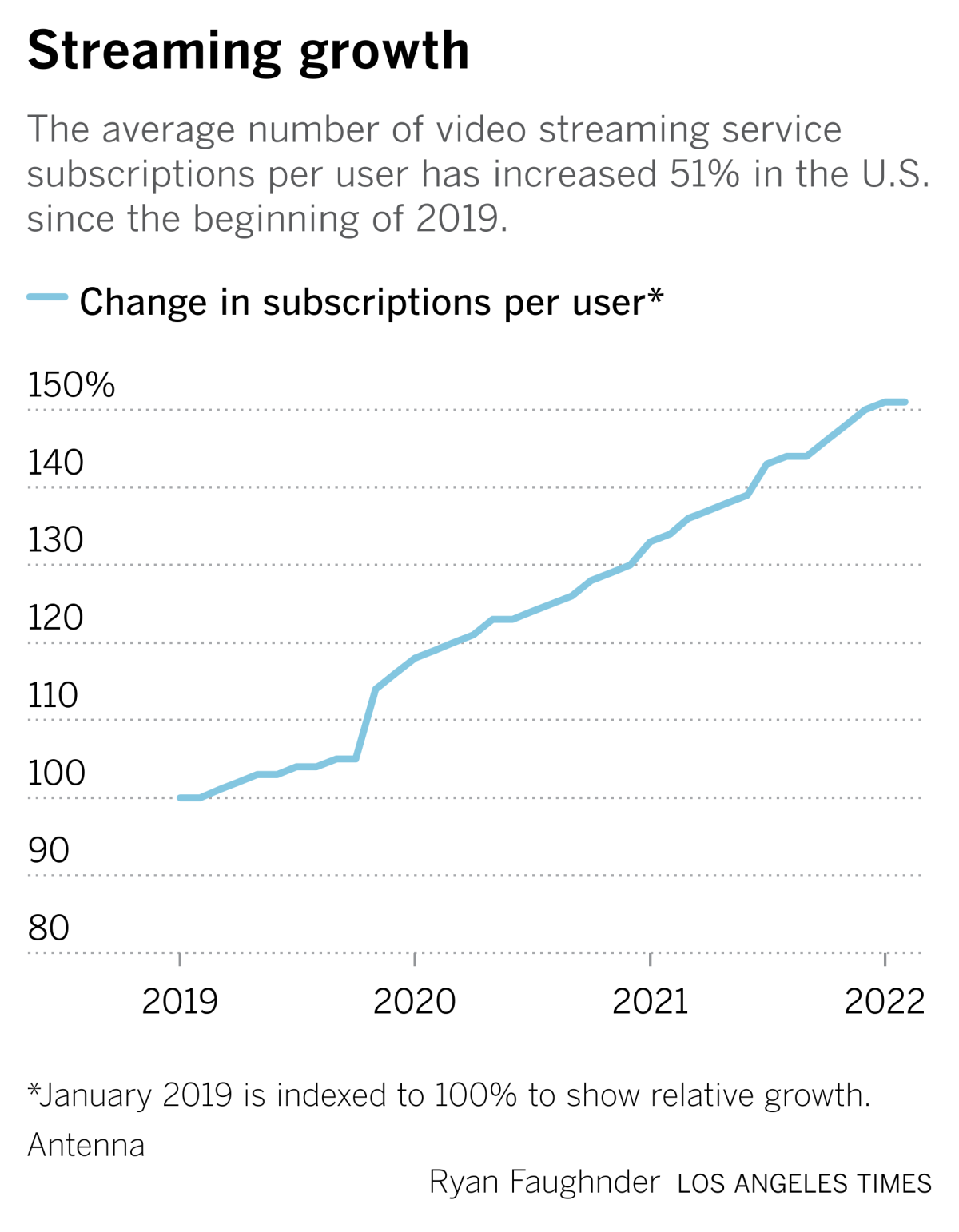

The video subscription business has gone through rapid growth in recent years, accelerated by the COVID-19 pandemic and new services coming onto the market. Because there are so many options for consumers, and canceling streaming subscriptions is so easy, media companies don’t just have to worry about acquiring enough subscribers. They increasingly have to fret about losing them too and about what causes them to bail.

This dynamic, called churn, is a major source of anxiety among companies trying to build their audiences in the streaming world. According to experts, the streaming business is moving into a new phase — one where subscriber retention becomes just as important as acquisition. Data analytics firm Antenna found that the average monthly churn for streaming video services reached 5.2% by the end of 2021, up from 3.2% at the start of 2019. According to a survey by Deloitte, 37% of people canceled a streaming subscription in the last six months.

“We’re in an intense growth stage,” said Jonathan Carson, co-founder of Antenna, a 30-person startup that operates remotely. “At some point, though, the players are going to have to start really shifting to retention. You already see that with Netflix and other developed, saturated brands. They are deploying lots of strategies to focus on retention.”

Founded in 2019, Antenna uses anonymized transaction data from 5 million U.S. consumers to figure out how long it takes people to ditch their subscriptions after blasting through Season 2 of “Bridgerton” on Netflix or “Severance” on Apple TV+.

Carson, a former Nielsen executive, launched the company with Axios alum Rameez Tase on the belief that there was a gap in the market for data that showed how audience behavior was shifting from the pay-TV bundle monopoly to direct-to-consumer services.

The company last month said it had completed a $10-million Series A financing round led by Bertelsmann Digital Media Investments, joined by investors including UTA Ventures. The new funding follows a $4.2-million seed round led by Raine Ventures in 2020. Antenna is looking to measure all areas of the “subscription economy,” including gaming (PlayStation Now, Ubisoft+), music (Apple Music, Spotify) and fitness (Beachbody, Peloton).

Carson and I discussed what the company’s data show about the future of streaming and the big trends affecting the battle of the video apps. Here are three top themes.

No. 1. The great rebundling is real

As companies try to slow the exodus of subscribers from their streaming services, they’ve come up with more mini-bundles and packages, promoting them as a way for viewers to get more shows for less money. The tactic seems to be working.

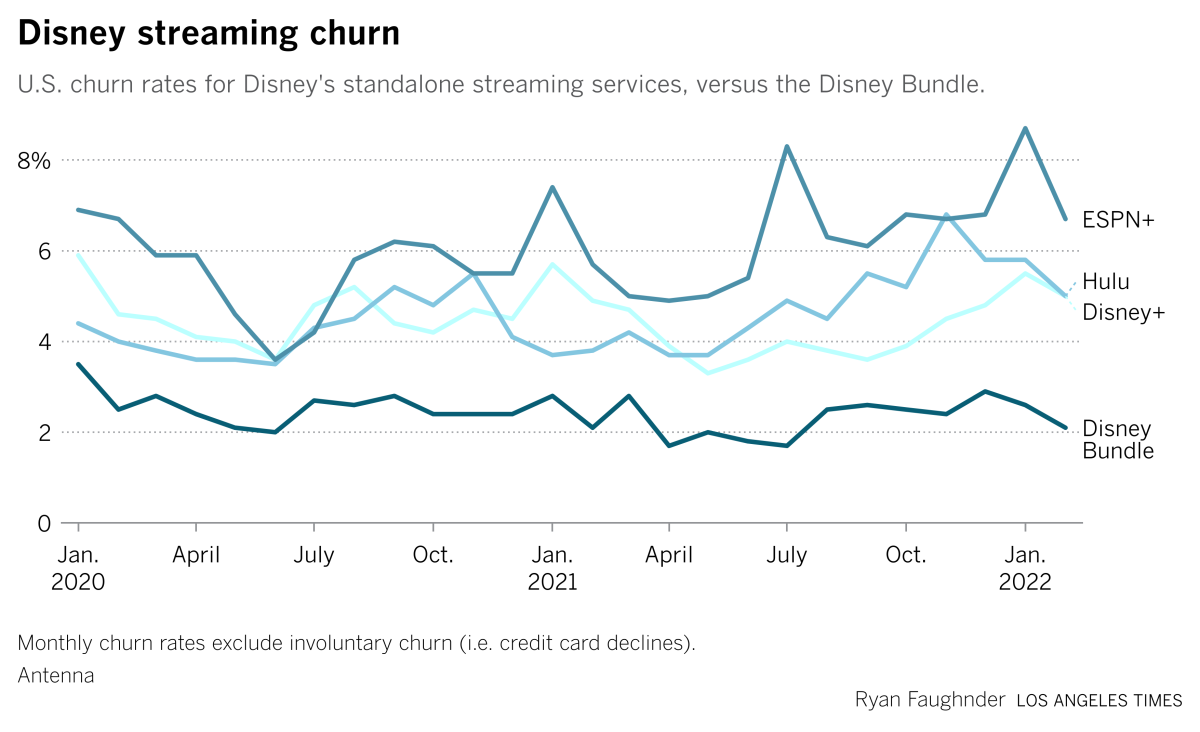

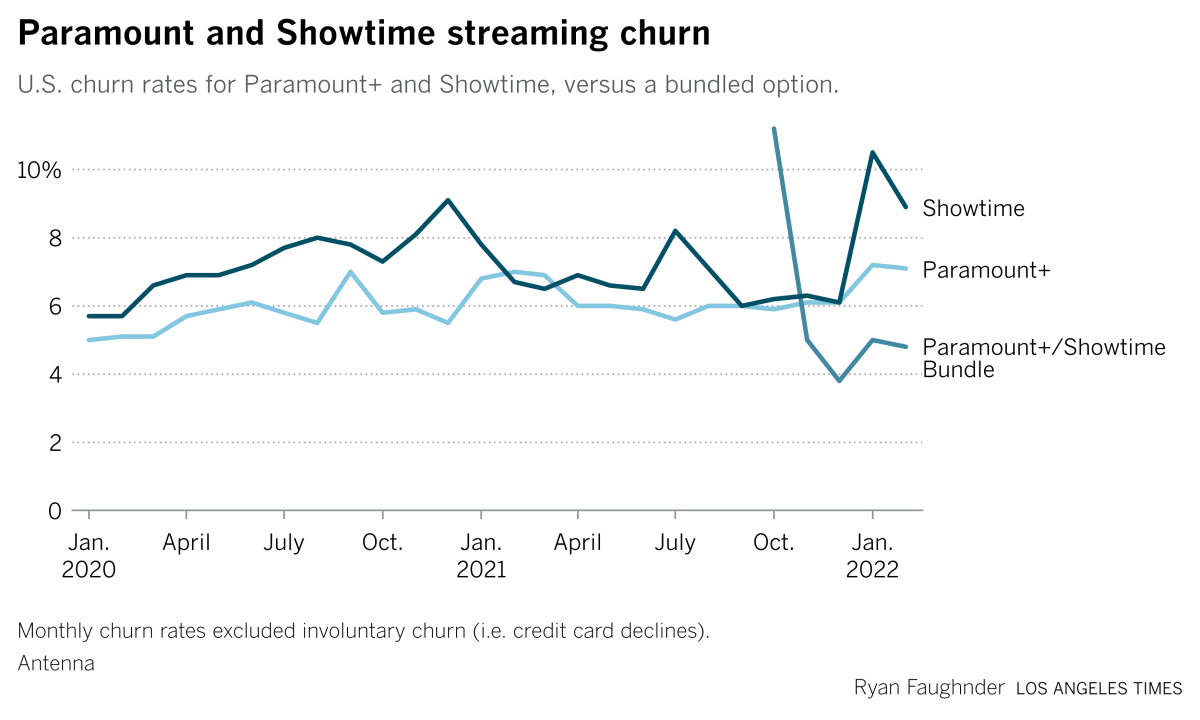

It’s already happening at Disney, which offers bundles of Disney+, Hulu and ESPN+ starting at $14 a month, while charging more for upgrades including live TV and ad-free Hulu. Disney automatically added Disney+ and ESPN+ to people’s Hulu+Live TV accounts while raising the price by $5 to start at $70 a month. Paramount Global is offering its pairing of Paramount+ and Showtime starting at $11.99 a month.

There’s a good reason for this trend. People are less likely to cancel Disney+ if it’s part of a package that gives them more stuff to watch. Having Paramount+ and Showtime together means much more content and makes it less likely that you’ll drop Showtime after finishing “Billions” or Paramount+ after bingeing “Mayor of Kingstown.”

Churn rates for the Disney Bundle were consistently lower than those for the standalone versions of Disney+, Hulu and ESPN+. Same goes for the more recently introduced package of Paramount+ and Showtime, compared to the individual versions of both services.

Bundling is in its early stages, and companies will probably try numerous combinations before figuring out the ideal format, Carson said. That could make things weird and confusing for viewers for a couple years. But it’s clear that offering people more programming through a single monthly payment is an effective way to manage churn. Which is something the cable business figured out decades ago.

No. 2. Why sports and week-to-week drops? Loyalty.

People love binge-watching TV shows. Movies bring streaming services a lot of attention and the chance for awards (Hello, Apple TV+ and best picture Oscar-winner “CODA.”) But one season of TV, released all at once, doesn’t give subscribers a reason to stick around. Neither does a two-hour movie.

The quest for loyal fans is partly what’s driving the battle for streaming sports rights. Apple TV+ has acquired the rights to show Friday night Major League Baseball games. Amazon Prime has Thursday Night Football, for which it’s paying $1 billion a year. NFL Sunday Ticket rights may go to a streamer — probably Amazon or Apple. Paramount+ and Peacock have made sporting events a key part of their appeal.

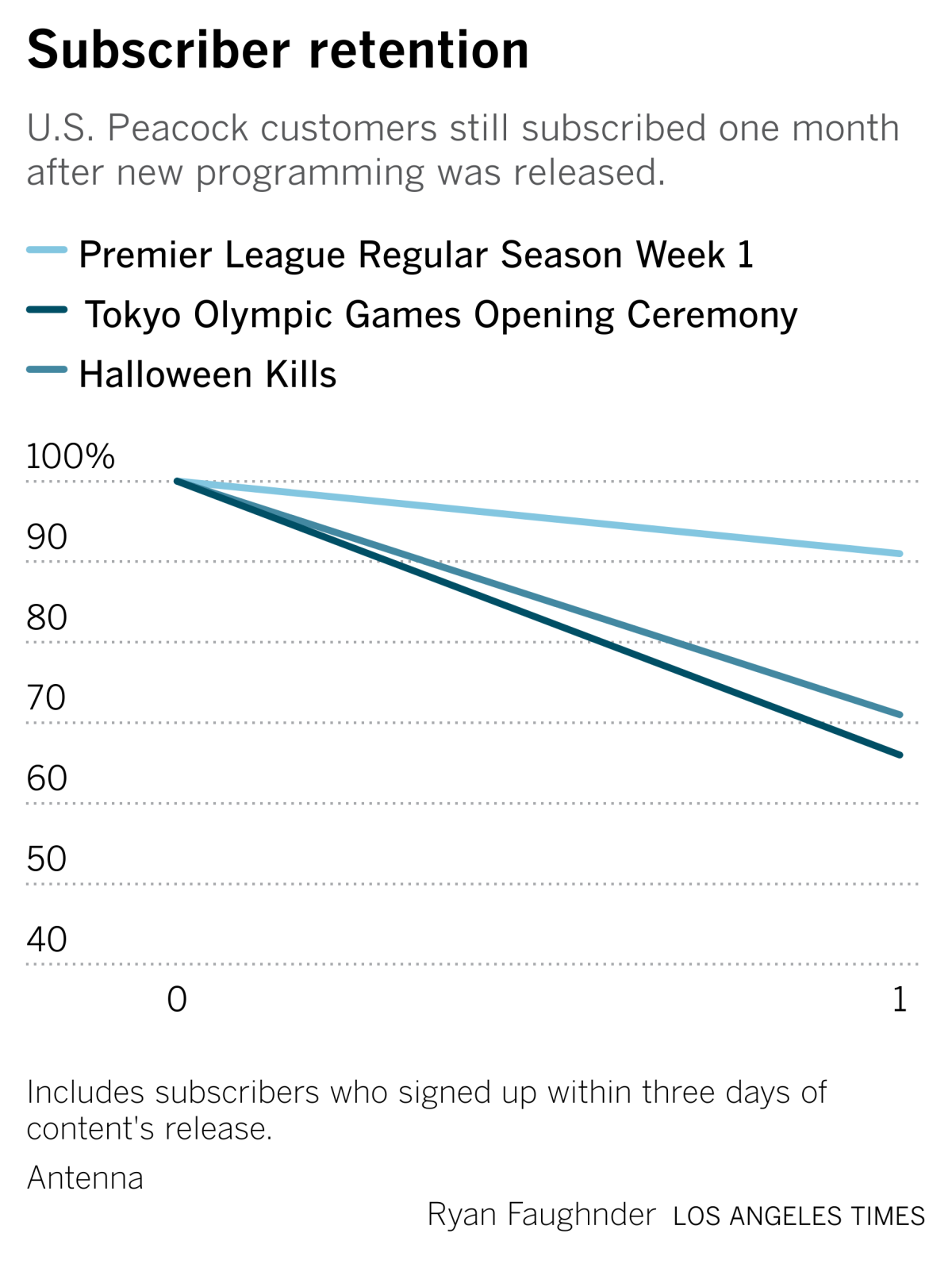

One might assume that viewers who join a streaming service for a sporting event would have a high churn rate. But that’s not necessarily the case. Sports fans tend to be avid repeat viewers.

Fans who signed up to see Premier League soccer on Peacock will probably stick around for a while, because the season lasts nine months. According to Antenna, more than 90% of people who subscribed to Peacock for the first week of Premier League matches were still paying a month later. That’s valuable for streamers because it allows them to expose viewers to other shows and movies on the platform.

“Retention for those sports signups are typically stronger than the normal signups,” Carson said. “That gives Peacock a nice, long window to win you over to the overall value of the library content and the original shows.”

Interestingly, the Tokyo Olympics appeared to have a lower retention rate than the horror film “Halloween Kills,” according to Antenna. Thirty-four percent of those who subscribed for the Summer Olympics opening ceremony were out within a month, compared to 29% who canceled after the release of the Michael Myers movie. The Olympics are different from normal sports because they are brief and happen only every two years, which probably explains the low retention.

Consumers’ fickle natures are also why companies are increasingly spacing out episodes the way traditional TV does, releasing installments week-to-week. Paramount+ and HBO Max tend to debut episodes a week apart. Peacock did weekly releases for “Bel-Air.” Amazon, which historically favored the binge-and-burn model, premiered the latest season of “The Marvelous Mrs. Maisel” two episodes at a time instead of all at once. Even Netflix is experimenting by breaking seasons of high-profile shows, like “Stranger Things,” into two parts. The move doesn’t just manage churn. Weekly drops help a series build steam, like “Succession” did for HBO.

“Netflix created a very disruptive precedent with the release of content all at once. It’s set an expectation in consumers’ minds,” Carson said. “So as the other services have been launching, they’ve been having to deal with that expectation. But I think now we’re at a point where they’ve been able to pull back on that expectation fairly successfully. Consumers are more tolerant that some programming is going to still be released episodically.”

No. 3: Is ‘subscription fatigue’ a myth?

We may think that the number of companies competing for our eyeballs, and asking us to pay $5 to $15 a month, is getting exhausting and expensive. Disney+, Apple TV+, HBO Max, Peacock and Paramount+ launched within a couple years of each other, making it hard to keep all the shows and movies straight. WarnerMedia just launched CNN+, offering the news app for a promotional $3 a month before the standard $6 rate kicks in.

But it’s not clear that this is preventing people from continuing to stack up on subscriptions.

Conventional wisdom among analysts holds that audiences would make room in their lives and budgets for only three to five subscription video services at once. But according to Carson, data collected by Antenna do not support the narrative of growing “subscription fatigue.”

In fact, numbers suggest that when a new streamer enters the market, the average number of subscriptions per person increases slightly. So when consumers decide to sample a new service, they’re not necessarily canceling others to do so. Since January 2019, the year the streaming wars kicked into high gear, the average number of streaming services per user has grown by 51%, according to Antenna data. (Antenna does not share estimates of the raw average number of services per person.)

“As consumers are trying Paramount+, they were not doing that by cancelling Netflix,” Carson said. “It was an ‘and’ rather than an ‘or.’ We’re not seeing that sign of fatigue.”

People logically tend to compare the streaming business to the traditional cable bundle. But that’s not the right way to look at it, Carson argues. Rather, the streaming business is more like print media in a way. News consumers, in the print heyday, subscribed to a mix of publications. A national newspaper. Maybe a local paper too. Plus a mix of general interest magazines (Time, Newsweek) and special interest publications (Sports Illustrated, Rolling Stone).

If streaming is the same way, with niche players able to thrive among the giants, there’s a lot of space for companies to grow.

Stuff we wrote

— Concerns about Bruce Willis’ declining cognitive state swirled around sets in recent years. On Wednesday, the 67-year-old movie star’s family said he would retire from acting because he has aphasia, a condition that affects a person’s ability to communicate. My colleagues Meg James and Amy Kaufman published a deeply reported and troubling story, saying that filmmakers who’ve worked with the “Sixth Sense” and “Die Hard” star have long been worried about Willis’ declining condition and took measures to accommodate, including cutting dialogue.

— One of Chris Rock’s brothers isn’t accepting Will Smith’s apology. Wendy Lee spoke with Kenny Rock, who wants Smith’s “King Richard” Oscar rescinded for you know what. The actor resigned from the Academy of Motion Picture Arts and Sciences last week before the academy managed to conclude its own disciplinary review.

— Disney and the culture war. The Walt Disney Co. spoke out against Florida’s so-called “Don’t Say Gay” bill in response to concerned employees. Now, the company is a political target. Some Republican state lawmakers want to repeal the 1967 Florida law that established the Reedy Creek Improvement District, which grants Disney extraordinary powers of self-government. Gov. Ron DeSantis is lending his support to that effort.

— Grammys only slightly louder. TV viewing for CBS’ drama-free telecast of the 64th Grammy Awards ceremony will be only a little above last year’s all-time low, Stephen Battaglio reports. Early Nielsen data indicated that the CBS telecast averaged 8.93 million viewers, a notch above the comparable figure of 8.8 million in 2021. The final figure last year was 9.2 million viewers.

— Hollywood backlots remained nearly full during the pandemic. Anousha Sakoui reports that the average annual soundstage occupancy rate reached 94% in 2020, up from 93% in 2019, according to a new report from Film LA, the nonprofit group that handles film permits for the city and county. Here’s why.

Number of the week

“The Lost City,” a movie with an original story starring Sandra Bullock and Channing Tatum, launched a couple weeks ago with a $30-million weekend at the domestic box office. That’s not “Batman” money, but it’s a solid opening. Plus, it held on strong and has now taken in $54.6 million in the U.S. and Canada.

The Paramount Pictures release cost nearly $70 million to make, so it’s not profitable yet. But after the pretty good performance of MGM’s “Dog,” also starring Tatum, maybe there’s reason to think that the death of midtier nonfranchise films (and movie stars) has been exaggerated.

Franchises still dominate. The No. 1 movie domestically last weekend was Sony Pictures’ latest Marvel offering, “Morbius,” starring Jared Leto as the comic book vampire, which rode Spider-Man’s coattails to a so-so $39 million after receiving atrocious reviews. I wouldn’t be surprised if “The Lost City,” which got respectable reviews, ends up making more than “Morbius” during the course of its North American theatrical run.

You should be reading...

— CNN+ has Quibi vibes. Josef Adalian draws some unflattering comparisons between CNN’s new streamer and Jeffrey Katzenberg’s short-lived short-form experiment. (Vulture)

— ‘Morbius’ and when the critical consensus bites. Richard Newby on the long-gestating reaction to the film and the ugly side of movie criticism. What do we want from comic book films? (Hollywood Reporter)

— What happened to the Hollywood erotic thriller? Chris Lee picks up the pieces of a genre in disarray after “Deep Water.” (Vulture)

Finally... Pursuit of Slappyness

You didn’t think I would write a whole newsletter this week without referencing that again, did you?

There have now been so... many... takes. I was at the Comedy Cellar in New York on Tuesday night (two days after the incident), and even then it felt that although some in the audience wanted to talk about it, the comics were already mostly tired of it.

Anyway, Jerrod Carmichael’s opening monologue on “Saturday Night Live” did an excellent job of capturing the world’s exhaustion and fascination. Plus, it gave us the wonderful mental image of Lorne Michaels telling Carmichael that he should address it because “the nation needs to heal.” Carmichael has a new HBO comedy special too.

I watched a lot of movies while traveling, so here’s the list, most of which were viewed on planes:

- Sunday: “King Richard” (ha!)

- Sunday: “Old”

- Tuesday: “Top Gun” (1986)

- Saturday: “House of Gucci”

- Saturday: “C’mon, C’mon”

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.