Warner Bros. Discovery shares take a hit after earnings miss

Despite turning a profit on its streaming business, Warner Bros. Discovery shares were battered Friday morning after the company failed to hit its estimates on revenue and posted a larger-than-expected loss in the fourth quarter.

WBD saw its stock price drop as much as 13% after the company reported a loss of $400 million, or 16 cents a share. That was an improvement over the loss of $2.1 billion or 86 cents a share during the same period a year ago, but wider than the 6-cents-a-share loss analysts had expected.

Revenues came in at $10.3 billion, down 7% compared to the same period a year ago. Analysts had predicted revenue of $10.4 billion.

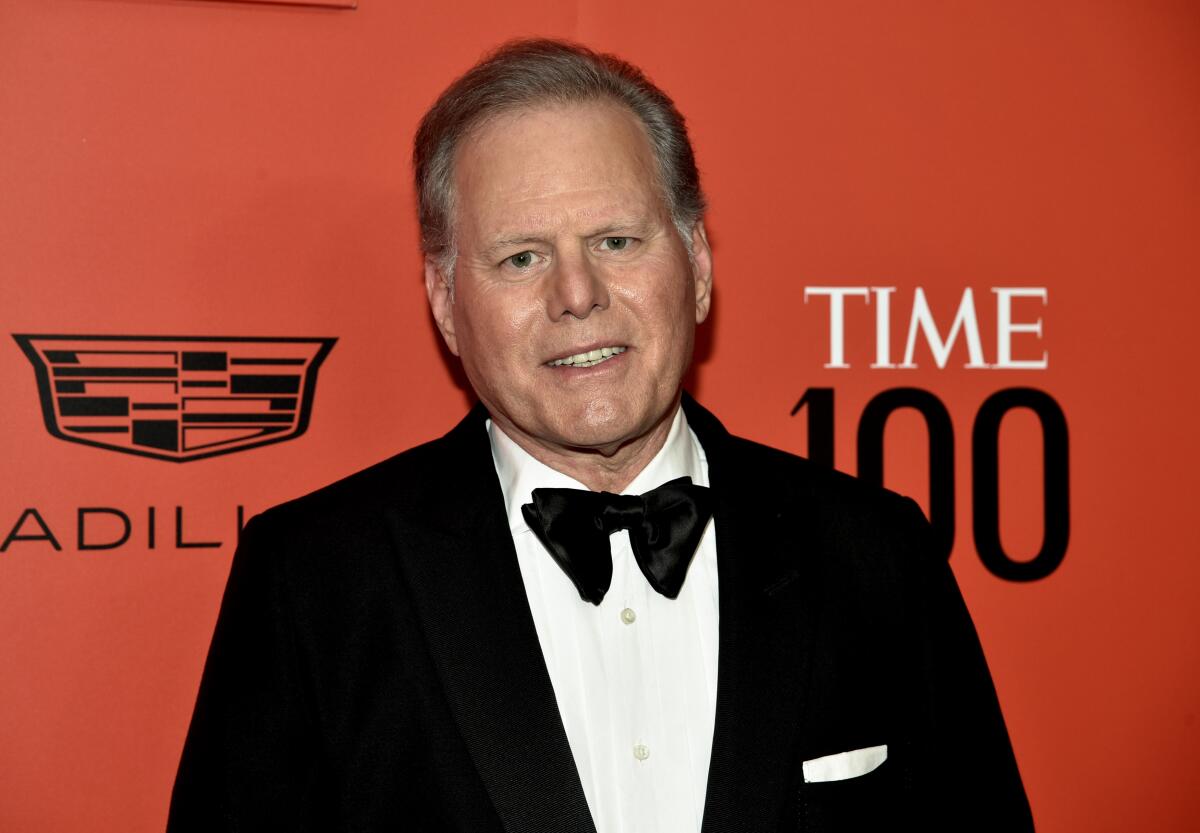

“This business is not without its challenges,” Chief Executive Officer David Zaslav said during an earnings call. “We continue to face the impacts of ongoing disruption in the pay TV ecosystem and a dislocated, linear advertising ecosystem.”

The stock was down as high as 13% in morning trading, putting its price under $9.

The media conglomerate cited softness in advertising demand for linear TV, seeing a 14% drop in ad revenue for its TV channels.

Ratings for linear television — which includes CNN, TNT, Discovery, Food Network, HGTV and other channels — continue to see a decline as consumers migrate to streaming platforms. Distribution fees from pay TV providers also declined 8%.

The dual strikes by the writers and actors last year also slowed down the pipeline of new programs on the TV side.

‘CNN News Central’ will air in an earlier time slot while Kasie Hunt, Jim Acosta and Pamela Brown get expanded roles.

WBD also continues to face challenges in the theatrical movie business, as fourth-quarter releases “The Color Purple” and “Aquaman and the Lost Kingdom” were not strong box office performers.

Studio revenue declined 17% to $3.17 billion, while pre-tax earnings plummeted 29% to $543 million in the quarter.

On the positive side, WBD’s direct-to-consumer streaming business, led by its Max platform, finished the full year with a $103-million pre-tax profit, reflecting deep reductions in content spending.

Media companies have been challenged to avoid losses in streaming as they invest heavily in programming in their effort to grow the number of subscribers.

Zaslav said Max is succeeding at retaining subscribers, as it had its lowest “churn” rate in its history. The service should be helped by an increased amount of content and growth in its ad-supported streaming business, Zaslav noted.

The company said it continues to make progress on reducing its debt, paying down $5.5 billion in 2023, and improving its free cash flow.

Zaslav said the company is “fully engaged” in contract renewal discussions on its media rights deal with the NBA. WBD is expected to face stiff competition for the package as Amazon and other tech giants are expected to compete for it.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.