Capitol Journal: A tax hike that no one could quibble about

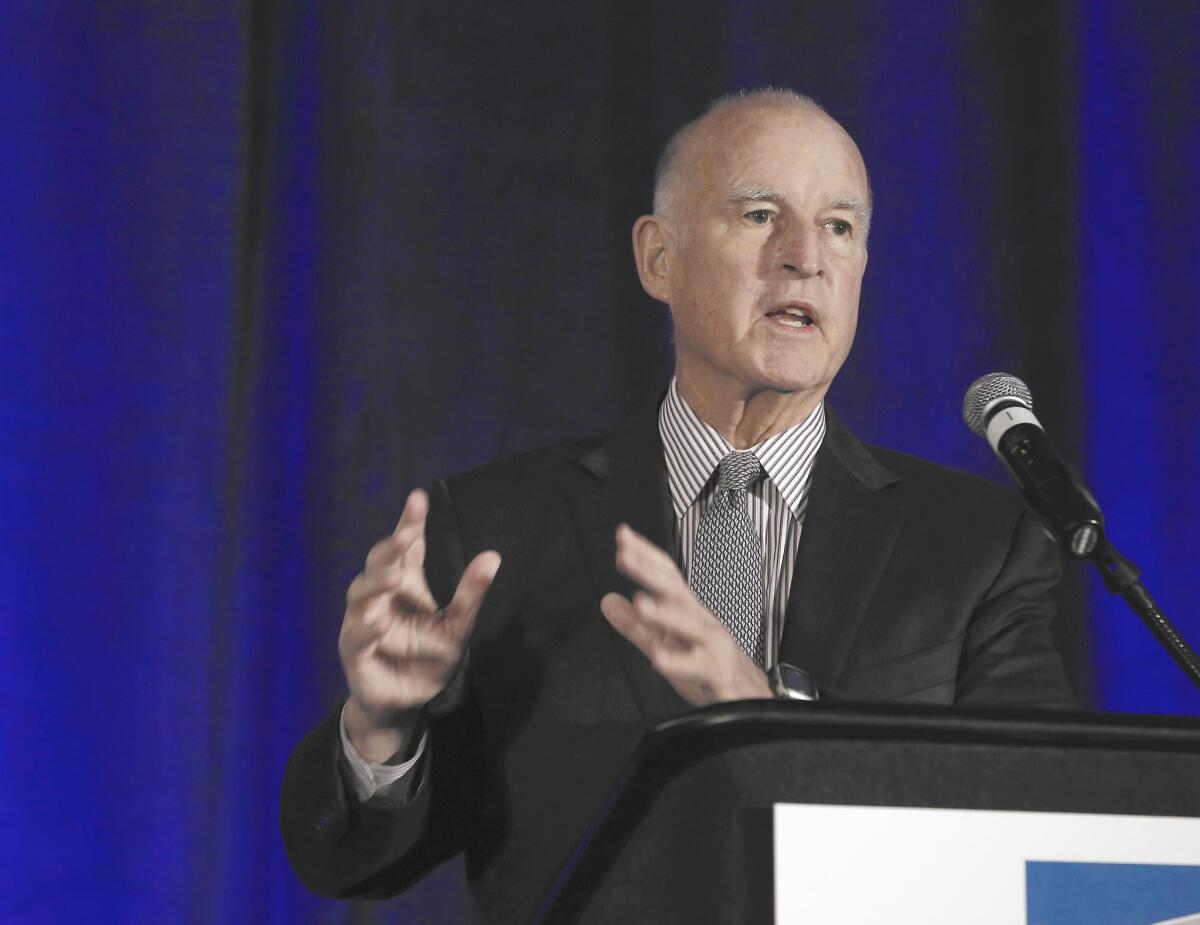

Gov. Jerry Brown is expected to quickly sign the tax on healthcare insurance plans when the Legislature sends him the measure.

Holy Howard Jarvis! California legislators are close to passing a tax increase.

But not even Jarvis, the iconic anti-tax rebel, is rolling over in his grave about this levy boost.

It’s a good government version of “give me your money and no one gets hurt.”

The taxpayers in this instance make out like bandits.

Yes, really.

Gov. Jerry Brown has been advocating the tax on healthcare insurance plans for months. He’ll quickly sign it once the Legislature sends him the measure. That should be in a few days.

It’s a tax to keep afloat Medi-Cal — California’s healthcare program for the poor — as it’s being loaded up with Obamacare beneficiaries.

Rapidly growing Medi-Cal covers more than one-third of the state’s residents. The federal Affordable Care Act has added 5 million people alone. Sacramento also has made Medi-Cal available to immigrant children who are in the country illegally.

But even without Obamacare and the immigrant kids, the tax might be necessary. That’s because the state has been taxing Medi-Cal managed care plans, but the feds say the levy can’t be limited just to Medi-Cal. And unless that changes by July 1, Washington will cut off $1 billion in funding.

So Brown proposes taxing non-Medi-Cal health plans too.

Naturally, there were objections, largely because Medi-Cal plans get reimbursed for the taxes with the help of matching federal money. But the non-Medi-Cal plans would not be.

Confused so far? So is practically everyone in Sacramento, at least those not fluent in government-ese.

Brown came up with a creative solution last month, but begged off trying to explain it to reporters. “It’s extremely complex,” he said. “Very few people understand it.... I couldn’t explain it to you if I wanted to.”

OK, here’s the simple version: All plans — Medi-Cal or not — would be taxed. Medi-Cal plans would pay at a higher rate. But they’d continue to be reimbursed.

This is the sweet spot: The non-Medi-Cal plans would benefit from having other state taxes — corporation and insurance — reduced or eliminated. So these plans would wind up $105 million ahead.

The state would pocket nearly $1.3 billion, thanks to the feds. That would fill the budget hole, plus leave $250 million for other health-related spending.

Where the surplus will go is still being negotiated. But a program sure to benefit is one that serves people with developmental disabilities. It has been starved since the recession.

This is a tax hike in name only.

Not even California’s most aggressive anti-tax lobby, the Howard Jarvis Taxpayers Assn. — named after the man who pushed the ballot measure that dramatically cut property taxes in 1978 — is fighting Brown’s proposal. It’s neutral.

“We don’t have a compelling reason to oppose this,” says Jon Coupal, the organization’s president. “If taxes are being offset by other tax reductions, there’s nothing to pass along to consumers.

“Frankly, we’ve got bigger fish to fry. Like the transportation tax. We’re going to plant our flag there.”

He’s referring to another Brown proposal — to increase fuel taxes to pay for repair of crumbling highways. That’s stalled in legislative gridlock.

The state Chamber of Commerce, California’s most powerful business lobby, supports the tax on health plans.

“It’s the right thing to do and makes sense,” says chamber President Allan Zaremberg. “However, on a pure political scale, there are people who are appropriately prudent — and should be.”

That’s because there are political consultants who make a good living by taking someone’s vote for an innocuous tax hike and turning it into an intolerable evil.

A Democratic legislator in a competitive district could be challenged for reelection by a Republican. Or, more likely, a Republican legislator in a strong GOP district could be attacked by a wannabe of the same party.

Because it’s a tax increase, this legislation will require a two-thirds vote. That means at least one Republican vote in the Senate and two in the Assembly.

Assembly Republicans seem to be mustering the nerve.

“I don’t think you should get scared by a phrase” like tax increase, says Assembly GOP leader Chad Mayes of Yucca Valley. “I think there’ll be a lot of support. We’re different than the Senate. We’ve delved in a little deeper.”

Sen. Joel Anderson (R-Alpine) has been leading the Senate GOP resistance.

“I believe the risk is way too great” that some insurers will pass on their tax hikes to premium payers, Anderson says. “Unless all the parts fall just right, this could be devastating to the state and to consumers. And I want is to be sure that this doesn’t lead to collapsing some insurance companies.”

Most insurance companies, however, seem to be OK with the tax.

Senate Health Committee Chairman Ed Hernandez (D-West Covina) says he expects voting this week. “I think the votes are there.”

Eagerly awaiting passage are supporters of last year’s bill that will allow terminally ill patients to swallow a lethal pill.

Both the “right-to-die” act and the healthcare tax were part of the same special legislative session. The law inspired by Brittany Maynard — a young woman with brain cancer — was signed by Brown but can’t take effect until 90 days after the special session ends. It will immediately after the healthcare tax is enacted.

It’s long past time to pass the tax, adjourn the session, permit the dying to end their suffering and move on to other issues. Like fixing the highways.

Twitter: @LATimesSkelton

ALSO:

Brown’s budget to include healthcare tax

Here’s what the Assembly GOP wants from healthcare tax negotiations

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.