Keeping healthcare on track

The 2010 healthcare law was supposed to be fully implemented on Jan. 1, 2014, but the Obama administration has pushed back several of the law’s requirements to give regulators and the public more time to prepare. Some critics have seized on the delays as a sign that the law is collapsing under its own weight, but that’s wishful thinking on their part. Though the implementation challenges are real, there’s no compelling reason at this point to think the reforms slated to begin next year can’t be made to work.

The most significant rollback was announced last week, when the Treasury Department said it would not enforce until 2015 the requirement that employers with at least 50 full-time workers provide them with affordable coverage. The department had been slow to set rules for how insurers and employers would report who had coverage, and many company executives had warned that they wouldn’t be ready to file those reports on time.

The announcement drew accusations from some conservatives that the administration was abusing its power, but the criticism is both cynical — they oppose the mandate, after all — and far-fetched. The point of the delay is to enforce the mandate when it can be done fairly, not to undermine it. Nor is it clear that the mandate would be effective in expanding coverage, as intended; instead, there are signs that it was deterring businesses from employing 50 or more full-time staff members.

VIDEO: Key healthcare law provision delayed by a year

The same reporting problems also will make it harder at first for operators of the new state insurance marketplaces, called exchanges, to verify whether certain applicants are qualified for subsidies. As a result, some cheats will be caught, if at all, only through enforcement after the fact — through random audits or when the Internal Revenue Service reviews their annual tax returns. That’s not ideal, but it’s no different from the way the government enforces compliance with most tax laws.

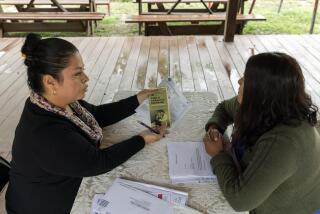

Those aren’t likely to be the final glitches the government encounters as it implements the Affordable Care Act. Launching the exchanges is a massive undertaking, and some states are struggling to be ready for the coming year. The federal government, which will be running or helping to run exchanges in 34 states, has just started testing its ability to work with insurers’ systems. It has only a few months to work out any kinks.

Yet given the scale of the changes called for in the law, it was inevitable that the road to implementation would be bumpy. At this point, at least, the biggest threats are political — from Republicans determined to repeal the law or, failing that, to prevent it from succeeding. Granted, getting the state insurance exchanges off to a good start is more important than starting them on time. But a good start is still possible, and as long as that remains true, federal and state governments should keep plowing ahead.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.