What’s in that spending bill? Lots of money and some lesser-known provisions

The deal reached was intended to draw support from all sides.

Congress passed a spending package in the wee hours of Friday morning that would keep government agencies running for the next two years.

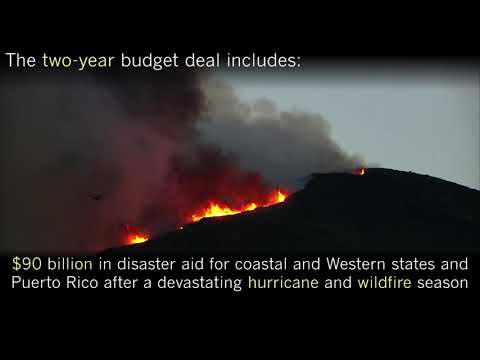

The bill would replace strict budget caps that were imposed on federal spending in 2011. It would boost military spending by about $80 billion in fiscal year 2018 and $85 billion in fiscal 2019. Non-defense accounts would go up by $63 billion in fiscal 2018 and $68 billion in fiscal 2019.

House approves bipartisan budget deal, ending brief shutdown »

The package also includes $90 billion in additional disaster aid for California and other western states hit by wildfires and for Puerto Rico and states hit by last fall’s hurricanes.

Here are five other things the bill, which President Trump is expected to sign, would do.

1. Boost funding for some public health programs

The bill includes:

$6 billion specifically for mental health and opioid-related programs

$4 billion for Department of Veterans Affairs hospitals and clinics

$2 billion in additional money for the National Institutes of Health

2. Extend the Children’s Health Insurance Program for 10 years

Congress had voted last month to extend the popular program for six years; the new bill would tack on four more years.

3. Raise the federal debt limit

The bill would raise the federal debt limit through March 1, 2019, taking a politically difficult issue off Congress’ plate for a year.

4. Eliminate the Independent Payment Advisory Board

The Independent Payment Advisory Board is a never-implemented body that was intended to find ways to hold down the cost of Medicare.

The board was created, in theory, by the Affordable Care Act, but has always been politically unpopular because of the possibility that it might, eventually, recommend cutbacks in care. In practice, no one has ever been appointed to it. And since the law, generally known as Obamacare, was passed, Medicare spending has grown more slowly than in previous years, so the board hasn’t been needed.

5. Extend a long list of special-interest tax breaks that were scheduled to expire soon

The list is so extensive that it takes up 65 pages of the legislation. Among the tax breaks that would be extended:

A break for owners of race horses, who are allowed to depreciate the value of their horses over three years.

Renewal of incentives for geothermal energy, small wind farms and fuel cells, which had been left out of a bill in 2015 that extended tax benefits for larger wind and solar power projects.

A tax credit for “carbon capture” technology in which power plants or other big sources of carbon dioxide pump the emissions underground. Some environmental scientists believe the technology, if it is perfected, could one day be a major tool for combating global warming.

An extension of a break for nuclear power plants that would help Southern Company, which is building two nuclear reactors in Georgia.

A tax credit for vehicles powered with biodiesel and other biofuels or with fuel cells.

A special break for a small college in Kentucky, the home state of Senate Majority Leader Mitch McConnell (R-Ky.). The measure would exempt Berea College from a new tax on schools with large endowments. Berea is distinctive because it does not charge tuition.

Twitter: @LisaMascaro

Twitter: @DavidLauter

UPDATES:

4:20 a.m.: This article was updated to reflect passage of the measure by both houses of Congress.

The article was originally published at 3:40 p.m. Thursday.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.