Consumer group files formal complaint of conflict against Gov. Jerry Brown’s top aide

A consumer advocates group filed a complaint Friday with the state’s ethics agency seeking an investigation into whether a top aide to Gov. Jerry Brown influenced appointments to the state Public Utilities Commission while she owned stock in Pacific Gas & Electric Co., which was seeking utility-friendly decisions.

The group, Consumer Watchdog, filed a complaint with the state Fair Political Practices Commission against Nancy McFadden, who left the firm to serve as Brown’s executive secretary two days after he took office in 2011. State disclosure forms show that she owned more than $100,000 in PG&E stock options that first year.

SIGN UP for the free Essential Politics newsletter >>

The formal complaint alleges McFadden violated the Political Reform Act “by using her official position to influence governmental decisions in which she knew she had a financial interest. Her actions impacted the value of the PG&E stock options she held.”

Jamie Court, the president of Consumer Watchdog, said state law prohibits public officials from influencing government decisions when they have a financial interest in the outcome, and he said there is no public record of McFadden’s recusal.

“The public deserves a straight answer about whether the governor’s top aide acted to help her former employer, PG&E, gain control of the Public Utilities Commission while holding six figure stock options in the company,” Court said Friday.

The commission’s attorneys are currently fighting a lawsuit seeking the release of correspondence with the governor’s office, and the complaint cites records already made public that may raise questions about the relationship between Brown’s closest adviser and her former employer.

The records include an email by Brian Cherry, then PG&E’s senior lobbyist, who the complaint said claimed to discuss commission appointments with McFadden. In turn, Cherry urged then Commission President Michael Peevey to suggest possible appointees.

“Nancy asks if you have any names you would recommend,” Cherry wrote to Peevey in January 2011. “You can call her directly if you’d like.”

A spokesman for Brown disputed the allegations, including the claim by Cherry.

“Nancy did not play a role in the decisions you’re asking about while she had these holdings,” said Evan Westrup, a spokesman for Brown. “Folks inflate their influence on and access to this office every day of the year in this town – and this individual is no different.”

Westrup added: “This filing is riddled with inaccuracies and has no merit.”

The emails were sent in early 2011, while McFadden owned between $100,001 and $1 million in PG&E stock options, according to a filing with the state. McFadden’s stock at her former employer was worth up to just $100,000 in 2012, her 2013 filing states. There was no reference to the date of and sale or the amount of income it provided.

She was given $1 million in severance payments by PG&E.

San Diego consumer attorney Michael Aguirre, who has challenged the closure terms of Southern California Edison’s San Onofre nuclear power plant, sued the PUC a year ago to get emails after a PG&E natural gas pipeline explosion killed eight people in San Bruno in 2010.

Back-channel dealings involving that San Onofre decision have been the focus of criminal investigators from the attorney general’s office.

Among other things, the San Bruno emails showed Peevey and other regulators traveling and dining with utility executives, often at lavish resorts and expensive restaurants, to discuss business pending before the commission.

Once those emails were released, Cherry and two other senior PG&E executives were fired. Peevey decided against seeking a third six-year term on the commission in October 2014 and has not commented publicly since.

In the emails from 2011, Peevey expressed concern with the effect of gubernatorial appointments on utility stock values.

“Jerry has to be made aware that actions have consequences and the economy is best off with a stable utility sector,” Peevey wrote to Cherry.

According to email exchanges, Cherry and Peevey paid extremely close attention to Wall Street analysts, two of whom downgraded stock issued by PG&E and Southern California Edison days after Brown’s inauguration.

Cherry sent Peevey one downgrade notification the morning of Jan. 11, 2011, saying only “FYI.”

“You should find a way to get this info to Brown as he makes his decisions on commissioners ASAP,” the commission president wrote back a couple of hours later.

Later an analyst from J.P. Morgan downgraded PG&E and Edison stock from “buy” to “hold” based on uncertainty across the sector created by two Brown nominations.

“J.P. Morgan stated that investors fear the governor could have swung the commission too far in the consumer-oriented direction,” a PG&E investor-relations analyst wrote to Cherry and other senior executives.

Cherry quickly forwarded the report to Peevey, who again urged Cherry to address his concerns to the Brown administration -- and specifically to his former coworker, McFadden.

“As I suggested before, this info should go the governor’s office, probably best to Nancy McF,” Peevey wrote Jan. 27.

Thirty-four minutes later, Cherry sent his reply to Peevey, telling him “Nancy” had solicited recommendations from the commission president.

Westrup, the spokesman for the governor, said the email suggesting communication between McFadden and the PG&E official is “inaccurate.”

McDonald writes for the San Diego Union-Tribune and McGreevy writes for the Los Angeles Times

ALSO

Chaos breaks out at Trump rally in Chicago

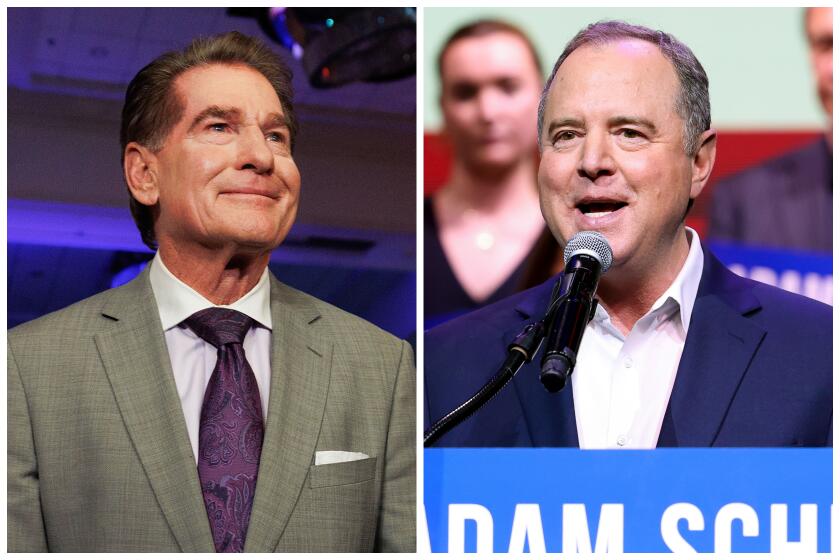

One of Hahn’s GOP opponents drops out of the race for L.A. County supervisor

State’s 22 unaccredited law schools will be required to show dropout rates in June

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.