Senators push Biden to fight to preserve the child tax credit

Five Democratic senators urged President Biden on Wednesday to continue to fight hard to extend the child tax credit, which he suggested last week might have to be dropped from a revamped version of his sweeping climate and domestic spending package.

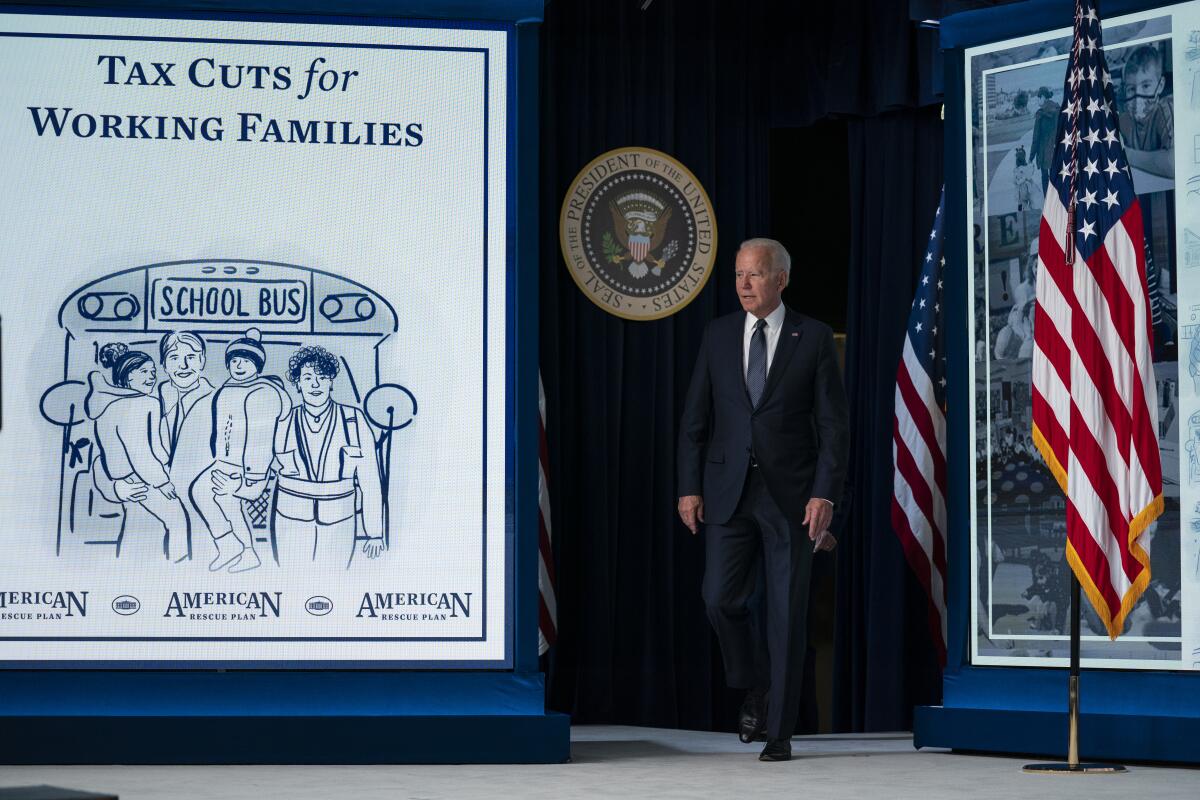

The credit, which delivered monthly payments of $250 or $300 per child to more than 35 million families last year, was included in the $1.9-trillion American Rescue Plan signed into law in March. The payments ended in December, and a one-year extension that had been included in Biden’s domestic spending bill is in jeopardy as lawmakers look to revamp the package in order to secure the 50 Senate votes needed to pass it.

In a letter to Biden, Democratic Sens. Michael Bennet of Colorado, Sherrod Brown of Ohio, Cory Booker of New Jersey, Raphael Warnock of Georgia and Ron Wyden of Oregon called the child tax credit “a signature policy achievement of this administration” and “the biggest tax cut for low- and middle-income families in modern American history.”

Last year’s payments, they noted, “are projected to reduce child poverty by more than 40%, [and] kept an estimated 3.7 million children out of poverty in December 2021 alone.”

The issue is yet another point of tension between the White House and an increasingly fractious Senate Democratic caucus as they seek to move past recent setbacks to salvage what they can of Biden’s ambitious domestic agenda, contained in a $1.75-trillion spending package that had been dubbed “Build Back Better.”

Biden knew his voting rights push was unlikely to succeed, yet felt he had to plunge ahead in the face of pressure from activists and other Democrats.

Although the legislation passed the House, it was derailed in December when Sen. Joe Manchin III (D-W.Va.) announced he was a firm no on the bill.

In a lengthy news conference last week marking his first year in office, Biden expressed optimism that he could save “chunks” of the legislation, primarily the $550 billion aimed at investments to address climate change and subsidies for preschool — the components Manchin has said previously he supports.

Manchin, the conservative Democrat whose vote would give his party the 50 votes necessary to pass the legislation through the budget reconciliation process, has been reluctant to extend the child tax credit.

In July at a White House event touting the child tax credit, Biden labeled it “a middle-class tax cut” and predicted it would engineer “the largest-ever one-year decrease in child poverty in the history of the United States of America.” But given the necessity of securing Manchin’s support for elements of his package, Biden was noncommittal last week about the prospects of renewing the child tax credit as part of any sort of legislative compromise.

“There’s two really big components that I feel strongly about that I’m not sure I can get in the package: one is the child care tax credit and the other is help for cost of community colleges,” Biden said during the news conference on Jan. 19. “They are massive things that I’ve run on, I care a great deal about, and I’m going to keep coming back at in whatever form I get to be able to try to get chunks or all of that done.”

With negotiations on a reconstituted spending package yet to begin in earnest, the five Democratic senators who wrote to Biden and were the primary backers of the child tax credit urged the president to dig in on the policy, noting that the monthly payments, which averaged $444 for participating families in December, “helped families cope with pandemic-induced price increases.”

For the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Not extending the tax credit, they argued, would amount to a tax increase for families.

“The consequences of failing to extend the CTC expansion are dire, particularly as families face another wave of the COVID-19 pandemic,” the senators wrote. “Without the expanded credit, nearly 10 million children will be thrown back into or deeper into poverty this winter, increasing the monthly child poverty rate from roughly 12% to at least 17%. After historic progress, it is unacceptable to return to a status quo in which children are America’s poorest residents and child poverty costs our nation more than $1 trillion per year. Raising taxes on working families is the last thing we should do during a pandemic.”

The senators also addressed one of Manchin’s main complaints about the tax credit — that it might be abused by parents to buy drugs. They pointed to census data showing that “91% of low-income families spent their payments on basic necessities like groceries, utilities, housing and school-related costs.”

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.